Bitcoin Price Breaking News BTC Hits $124K, Surpasses Google Market Cap

The cryptocurrency world is buzzing with excitement as the bitcoin price breaking news continues to dominate financial headlines. Bitcoin (BTC) has achieved yet another historic milestone, surging past $124,000 and surpassing tech giant Google to become the world’s fifth-largest asset by market capitalization.

This remarkable achievement represents a significant shift in the global financial landscape, with Bitcoin now commanding a market value that rivals some of the world’s most established corporations. The latest bitcoin price breaking news reflects unprecedented institutional adoption and regulatory clarity that’s driving this extraordinary bull run.

As investors worldwide scramble to understand the implications of this monumental surge, analysts are pointing to several key factors fueling Bitcoin’s meteoric rise. The combination of favorable regulatory policies under the Trump administration, increased corporate treasury adoption, and growing institutional interest has created a perfect storm for Bitcoin’s price appreciation.

Latest Bitcoin Price Breaking News Updates

Bitcoin Crosses Historic $124K Threshold

The most significant bitcoin price breaking news this week centers around BTC’s breakthrough above the $124,000 resistance level. This milestone reflects a year-long build in bullish sentiment, fueled by a friendlier regulatory backdrop under President Donald Trump and the rapid adoption of corporate treasury strategies centered on Bitcoin accumulation. Bitcoin rose as high as $124,496 on Wednesday, marking a new all-time high that has left even the most optimistic analysts surprised.

This latest surge represents more than just numerical significance. When examining the broader context of this Bitcoin price breaking news, we see Bitcoin’s market capitalization now exceeding $2.4 trillion, officially positioning it above Google’s market value. This achievement places Bitcoin among the world’s top five assets, joining gold, Apple, Microsoft, and NVIDIA in an exclusive club of multi-trillion-dollar assets.

Market Cap Milestone: Surpassing Tech Giants

The bitcoin price breaking news becomes even more remarkable when we consider the speed of this achievement. Bitcoin continues to defy sceptics, leaping past tech titans like Google and Amazon to become the world’s fifth-most valuable asset by market capitalisation. This progression has been nothing short of extraordinary, with Bitcoin systematically overtaking major corporations throughout 2025.

The journey to this position involved several significant milestones. Earlier this year, Bitcoin surpassed Amazon’s market cap, and more recently, it has overtaken Google, demonstrating the cryptocurrency’s growing legitimacy as a store of value and investment asset. Financial institutions that once dismissed Bitcoin as a speculative bubble are now acknowledging its role as a legitimate asset class.

Trump Administration’s Impact on Bitcoin Price Breaking News

Strategic Bitcoin Reserve Initiative

One of the most significant catalysts behind recent bitcoin price breaking news has been the Trump administration’s pro-cryptocurrency stance. The prospect of a federal strategic reserve is a major step in President Trump’s vision to establish the U.S. as the crypto capital of the world and could be a game-changer for the industry. The establishment of a Strategic Bitcoin Reserve represents a paradigm shift in how governments view cryptocurrency.

This policy initiative has provided unprecedented legitimacy to Bitcoin, with institutional investors viewing government backing as a green light for increased allocation. The psychological impact of having the U.S. government actively accumulating Bitcoin cannot be overstated, as it signals a fundamental shift in monetary policy and digital asset acceptance.

Regulatory Clarity Drives Institutional Adoption

The regulatory environment under the current administration has been notably favorable for cryptocurrency adoption. Clear guidelines and supportive policies have removed much of the regulatory uncertainty that previously hindered institutional investment. This clarity has been a driving force behind the recent Bitcoin price breaking news, as corporations and financial institutions now have a clearer framework for Bitcoin integration.

Major corporations are increasingly adding Bitcoin to their treasury reserves, following the lead of companies like MicroStrategy and Tesla. This corporate adoption trend has created sustained buying pressure, contributing significantly to the price appreciation we’re witnessing in the current bitcoin price breaking news.

Technical Analysis and Price Predictions

Current Market Dynamics

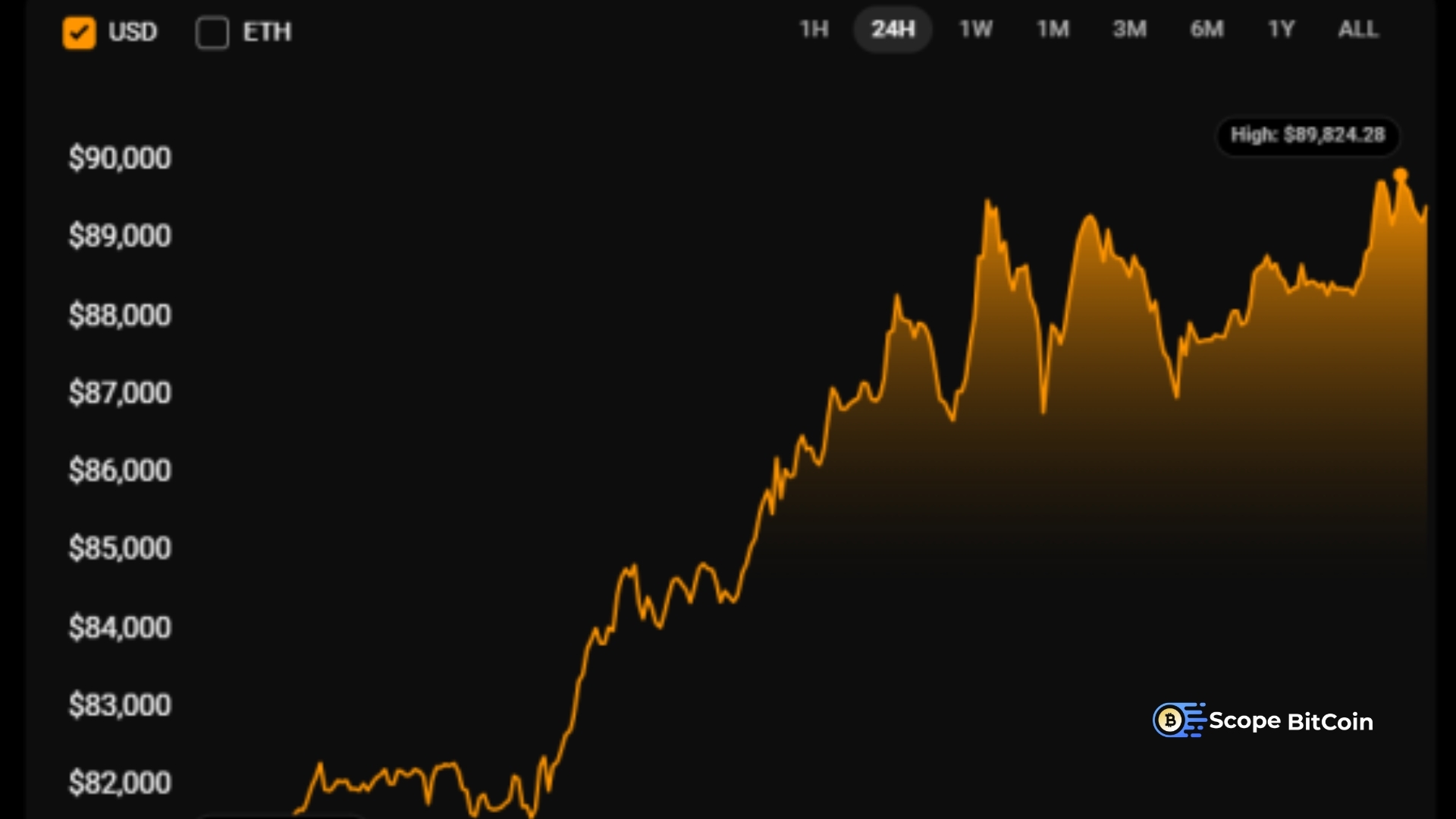

From a technical perspective, the latest bitcoin price breaking news reveals strong momentum indicators across multiple timeframes. This week, Bitcoin looks set to keep moving within that well-worn $114K–$123K range it’s been respecting lately. Daily trading activity has been strong but not overheated, so it wouldn’t take a massive burst of buying to push through the all-time high at $123,218.

The breakthrough above $124,000 has now established this level as crucial support, with analysts identifying the next resistance zones between $125,000 and $128,000. The technical structure suggests that Bitcoin’s upward trajectory remains intact, with pullbacks viewed as healthy consolidation rather than trend reversals.

Expert Price Predictions for 2025

Cryptocurrency analysts are increasingly bullish following the recent bitcoin price breaking news. Bitcoin’s growth trajectory points to $200,000 by 2025, and the potential for BTC price to exceed $1 million in the longer term. These predictions, while ambitious, are based on fundamental factors including limited supply, increasing demand, and institutional adoption.

Respected Crypto chartist Dave the Wave is back with another macro Bitcoin forecast, and this one’s spicy — a conservative Bitcoin technical target of $170,000 in 2025. Such predictions from respected analysts add credibility to the bullish sentiment surrounding Bitcoin’s future price potential.

Institutional Investment Trends

Corporate Treasury Adoption

The corporate world’s embrace of Bitcoin as a treasury asset has been a significant driver behind recent Bitcoin price-breaking news. Companies across various sectors are recognizing Bitcoin’s potential as a hedge against inflation and currency debasement. This institutional adoption represents a fundamental shift from Bitcoin being viewed as a speculative asset to being recognized as a legitimate store of value.

The trend began with pioneering companies like MicroStrategy, which has accumulated substantial Bitcoin holdings, and has since spread to traditional corporations seeking to diversify their treasury reserves. This institutional demand creates sustained buying pressure that supports higher Bitcoin valuations.

Financial Services Integration

Traditional financial services firms are increasingly integrating Bitcoin into their offerings, responding to growing client demand. Investment banks, wealth management firms, and even pension funds are exploring Bitcoin allocation strategies. This mainstream financial adoption legitimizes Bitcoin and creates additional demand from previously untapped investor segments.

The integration of Bitcoin into traditional financial products, including ETFs and structured products, has made cryptocurrency investment accessible to a broader range of investors. This increased accessibility has contributed significantly to the positive momentum reflected in recent bitcoin price-breaking news.

Global Economic Factors

Inflation Hedge Properties

Bitcoin’s performance as an inflation hedge has become increasingly relevant in the current economic environment. As central banks worldwide continue expansionary monetary policies, investors are seeking assets that can maintain purchasing power over time. Bitcoin’s fixed supply cap of 21 million coins makes it an attractive alternative to traditional fiat currencies.

The recent Bitcoin price breaking news demonstrates Bitcoin’s effectiveness as a store of value during periods of monetary uncertainty. Institutional investors increasingly view Bitcoin as “digital gold,” recognizing its potential to preserve wealth in an inflationary environment.

Geopolitical Influences

Global geopolitical tensions and currency instabilities have contributed to Bitcoin’s appeal as a neutral, borderless asset. Countries experiencing currency crises or political instability often see increased Bitcoin adoption as citizens seek to protect their wealth. This global demand creates additional upward pressure on Bitcoin prices.

The decentralized nature of Bitcoin makes it attractive to investors seeking assets outside traditional financial systems. This characteristic has become increasingly valuable as geopolitical uncertainties continue to influence global markets.

Market Sentiment and Future Outlook

Investor Confidence Indicators

Current market sentiment surrounding Bitcoin remains overwhelmingly positive, as reflected in recent Bitcoin price breaking news. On-chain metrics, including long-term holder behavior and exchange inflows/outflows, suggest strong conviction among Bitcoin investors. The reduction in selling pressure from long-term holders indicates confidence in Bitcoin’s continued appreciation.

Social sentiment indicators and search trends also support the bullish thesis, with increased mainstream interest driving additional investment flows. This positive sentiment cycle reinforces upward price momentum and supports sustained growth.

Challenges and Risk Factors

Despite the positive momentum in the bitcoin price breaking news, potential challenges remain. Regulatory changes, market volatility, and macroeconomic shifts could impact Bitcoin’s trajectory. However, the strengthening institutional foundation provides greater stability compared to previous market cycles.

Environmental concerns related to Bitcoin mining continue to be discussed, though improvements in mining efficiency and renewable energy adoption are addressing these issues. The development of more sustainable mining practices supports Bitcoin’s long-term viability and mainstream acceptance.

Technology and Network Developments

Lightning Network Growth

The Bitcoin Lightning Network continues to expand, improving transaction speed and reducing costs. This second-layer solution addresses scalability concerns and enables Bitcoin to function more effectively as a medium of exchange. Lightning Network growth supports the fundamental value proposition underlying recent bitcoin price-breaking news.

Payment processors and merchants increasingly adopt Lightning Network solutions, expanding Bitcoin’s utility beyond store-of-value applications. This technological development strengthens Bitcoin’s position as both a settlement layer and a payment system.

Mining Industry Evolution

The Bitcoin mining industry continues to evolve, with increased focus on efficiency and sustainability. Mining operations are increasingly powered by renewable energy sources, addressing environmental concerns while reducing operational costs. This evolution supports the long-term sustainability of the Bitcoin network.

Institutional mining operations and publicly traded mining companies provide additional legitimacy to the Bitcoin ecosystem. These developments contribute to the positive narrative surrounding Bitcoin and support the momentum reflected in recent Bitcoin price-breaking news.

International Adoption Trends

Central Bank Digital Currencies (CBDCs) Impact

The development of Central Bank Digital Currencies worldwide has increased awareness of digital assets generally. While CBDCs differ fundamentally from Bitcoin, their development validates the concept of digital money and may indirectly support Bitcoin adoption by increasing comfort with digital assets.

Countries exploring CBDC implementations are also reconsidering their approaches to cryptocurrency regulation. This regulatory evolution often results in clearer frameworks that support legitimate cryptocurrency use, benefiting Bitcoin adoption and price appreciation.

Emerging Market Adoption

Emerging markets continue to show strong Bitcoin adoption rates, driven by factors including currency instability, inflation, and limited access to traditional financial services. Countries like El Salvador have made Bitcoin legal tender, while others are exploring similar policies.

This international adoption creates additional demand sources that contribute to the positive trends reflected in the bitcoin price breaking news. As more countries and regions embrace Bitcoin, the global demand base expands, supporting higher valuations.

Also Read: Bitcoin Breaking News Price Alerts Real Time Crypto Notifications Guide 2025

Conclusion

The latest bitcoin price breaking news represents more than just another price milestone – it signifies Bitcoin’s evolution into a legitimate global asset class. With BTC surpassing $124,000 and overtaking Google’s market capitalization to become the world’s fifth-largest asset, we’re witnessing a historic transformation in the financial landscape.

The convergence of favorable regulatory policies, institutional adoption, and growing mainstream acceptance has created an unprecedented foundation for Bitcoin’s continued growth. As we move forward, staying informed about bitcoin price-breaking news will be crucial for investors and market observers alike.

Whether you’re a seasoned cryptocurrency investor or just beginning to explore digital assets, now is the time to stay updated with the latest developments. Subscribe to our newsletter for real-time bitcoin price breaking news and expert analysis to help guide your investment decisions in this rapidly evolving market.