Bitcoin Price Analysis Technical Indicators Signals Expert Trading Guide 2025

Bitcoin price analysis technical indicators signals have become the cornerstone of successful cryptocurrency trading in today’s volatile market. As digital assets continue to reshape the financial landscape, understanding how to interpret technical indicators and trading signals is crucial for making informed investment decisions. Whether you’re a seasoned trader or just beginning your crypto journey, mastering Bitcoin price analysis through technical indicators signals can significantly improve your trading outcomes and risk management strategies.

The cryptocurrency market operates 24/7, making it essential for traders to rely on objective, data-driven approaches rather than emotional decision-making. Technical analysis provides the framework for understanding market sentiment, trend direction, and potential price movements through various mathematical calculations and chart patterns. By combining multiple technical indicators with proper signal interpretation, traders can develop a comprehensive understanding of Bitcoin’s price action and market dynamics.

Understanding Bitcoin Technical Analysis Fundamentals

Technical analysis forms the backbone of modern cryptocurrency trading, offering traders a systematic approach to evaluate Bitcoin’s price movements. Unlike fundamental analysis, which focuses on underlying economic factors, technical analysis examines historical price data, trading volume, and market patterns to predict future price movements.

The foundation of Bitcoin technical analysis rests on three core principles: price movements follow trends, history tends to repeat itself, and market action discounts all available information. These principles guide traders in identifying optimal entry and exit points while managing risk effectively.

Bitcoin’s unique characteristics as a decentralized digital asset create distinct technical patterns that differ from traditional financial markets. The cryptocurrency’s high volatility, 24-hour trading cycle, and global accessibility contribute to rapid price movements that can be captured through proper technical analysis techniques.

Essential Technical Indicators for Bitcoin Price Analysis

Moving Averages The Foundation of Trend Analysis

Moving averages represent one of the most fundamental technical indicators used in Bitcoin price analysis. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) help traders identify trend direction and potential reversal points by smoothing out price fluctuations over specific periods.

The 50-day and 200-day moving averages are particularly significant in Bitcoin trading, with their crossover points often indicating major trend changes. When the 50-day MA crosses above the 200-day MA, it creates a “golden cross” signal, typically suggesting bullish momentum. Conversely, when the 50-day MA crosses below the 200-day MA, it forms a “death cross,” often indicating bearish conditions.

Short-term traders frequently utilize the 20-day EMA for dynamic support and resistance levels, while longer-term investors rely on the 200-day SMA to gauge overall market sentiment. The relationship between Bitcoin’s price and these moving averages provides valuable insights into market strength and potential trend continuation or reversal.

Relative Strength Index (RSI) Measuring Market Momentum

The Relative Strength Index serves as a crucial momentum oscillator in Bitcoin price analysis, technical indicators signals. RSI measures the speed and magnitude of price changes on a scale from 0 to 100, helping traders identify overbought and oversold conditions in the market.

When Bitcoin’s RSI exceeds 70, it typically indicates overbought conditions, suggesting a potential price correction or consolidation phase. Conversely, RSI readings below 30 often signal oversold conditions, potentially presenting buying opportunities for contrarian traders.

However, during strong trending markets, RSI can remain in overbought or oversold territory for extended periods. Experienced traders combine RSI with other technical indicators to confirm signals and avoid false breakouts or premature position entries.

MACD Trend Following and Momentum Analysis

The Moving Average Convergence Divergence (MACD) indicator combines trend-following and momentum characteristics, making it invaluable for Bitcoin price analysis. MACD consists of three components: the MACD line, signal line, and histogram, each providing unique insights into market dynamics.

MACD crossovers generate powerful trading signals when properly interpreted. A bullish signal occurs when the MACD line crosses above the signal line, particularly when both lines are below zero. Bearish signals emerge when the MACD line crosses below the signal line, especially above the zero line.

The MACD histogram reveals the strength of momentum changes, with expanding histogram bars indicating accelerating momentum and contracting bars suggesting weakening momentum. This information helps traders anticipate potential trend changes before they become apparent in price action.

Advanced Bitcoin Price Analysis Technical Indicators Signals

Bollinger Bands Volatility and Price Extremes

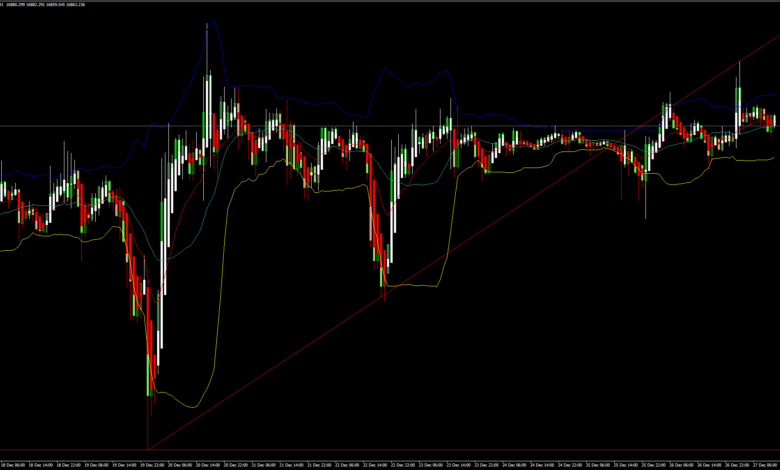

Bollinger Bands provide exceptional insight into Bitcoin’s volatility and potential price extremes through three plotted lines: a middle band (typically a 20-period moving average) and upper and lower bands representing standard deviations from the middle band.

When Bitcoin’s price touches or exceeds the upper Bollinger Band, it often indicates overbought conditions and potential resistance. Price contact with the lower band frequently suggests oversold conditions and possible support levels. The width of the bands reflects market volatility, with expanding bands indicating increasing volatility and contracting bands suggesting consolidation periods.

The “Bollinger Band Squeeze” occurs when volatility reaches extremely low levels, often preceding significant price movements. Traders monitor these squeeze formations as potential breakout signals, positioning themselves for substantial price movements in either direction.

Fibonacci Retracements Natural Support and Resistance

Fibonacci retracement levels play a crucial role in Bitcoin price analysis, technical indicators signal by identifying natural support and resistance levels based on mathematical relationships found throughout nature. The key Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 78.6%) often act as significant turning points in Bitcoin’s price action.

During uptrends, traders use Fibonacci retracements to identify potential buying opportunities at support levels, while downtrends present selling opportunities at resistance levels. The 61.8% retracement level, known as the “golden ratio,” frequently provides the strongest support or resistance.

Combining Fibonacci levels with other technical indicators enhances signal reliability and helps traders identify high-probability trading opportunities with favorable risk-to-reward ratios.

Volume Analysis Confirming Price Movements

Volume analysis provides crucial confirmation for Bitcoin price movements and technical signals. Genuine breakouts typically occur with increased trading volume, while false breakouts often exhibit low volume participation.

On-Balance Volume (OBV) and Volume Price Trend (VPT) indicators help traders assess the relationship between price and volume, revealing accumulation or distribution patterns that may not be immediately apparent from price action alone.

Rising volume during upward price movements confirms bullish momentum, while increasing volume during price declines validates bearish pressure. Divergences between price and volume often precede trend reversals, providing early warning signals for experienced traders.

Signal Interpretation and Trading Strategies

Confluence Trading Combining Multiple Signals

Successful Bitcoin price analysis technical indicators signals interpretation requires combining multiple indicators to create confluence zones where several signals align. This approach significantly improves signal reliability and reduces false signals that can lead to trading losses.

For example, a bullish confluence might occur when Bitcoin’s price breaks above a key resistance level, RSI moves from oversold to neutral territory, MACD generates a bullish crossover, and volume increases substantially. This combination of confirming signals provides higher confidence for entering long positions.

Conversely, bearish confluence develops when price breaks below support, RSI enters overbought territory, MACD shows bearish divergence, and volume confirms the breakdown. These aligned bearish signals suggest higher probability short opportunities or profit-taking levels for existing long positions.

Risk Management Through Technical Analysis

Effective risk management remains paramount in Bitcoin trading, and technical indicators provide valuable tools for setting appropriate stop-loss levels and position sizing. Support and resistance levels identified through technical analysis help traders determine optimal risk-to-reward ratios for each trade.

The Average True Range (ATR) indicator helps traders adjust position sizes based on Bitcoin’s current volatility, ensuring consistent risk exposure across different market conditions. Higher ATR readings suggest larger position sizes require smaller allocations, while lower volatility periods may allow for increased position sizes.

Stop-loss placement below significant support levels or above resistance levels helps protect capital while allowing trades sufficient room to develop. Trailing stops based on moving averages or volatility-adjusted levels help lock in profits while maintaining upside potential.

Market Sentiment and Psychological Levels

Bitcoin price analysis technical indicators signals must also consider market sentiment and psychological price levels that influence trader behavior. Round numbers (such as $30,000, $50,000, or $100,000) often act as significant psychological barriers that create support or resistance.

Fear and Greed Index readings provide additional context for interpreting technical signals, with extreme fear often coinciding with oversold technical conditions and extreme greed aligning with overbought indicators. Contrarian traders use these sentiment extremes to identify potential reversal opportunities.

Social sentiment analysis and news flow can either confirm or contradict technical signals, providing additional layers of confirmation for trading decisions. However, technical analysis should remain the primary decision-making framework, with sentiment serving as supplementary information.

Real World Application and Case Studies

Identifying Trend Reversals

Bitcoin’s major trend reversals often provide clear examples of how multiple technical indicators can align to signal significant price movements. The 2020 bull market began to show classic bullish signals across multiple timeframes, including golden cross formations, RSI momentum shifts, and volume confirmation.

Similarly, the 2022 bear market demonstrated how bearish technical signals can persist across extended periods, with death crosses, RSI divergences, and volume patterns confirming the downward trend. Understanding these historical patterns helps traders recognize similar setups in current market conditions.

Pattern recognition skills develop through consistent application of technical analysis principles and regular market observation. Traders who maintain detailed trading journals documenting their signal interpretation and results typically improve their analysis accuracy over time.

Short Term vs. Long Term Signal Analysis

Different timeframes require adjusted approaches to Bitcoin price analysis, technical indicators signals. Short-term traders focusing on intraday movements rely heavily on momentum indicators like RSI, Stochastic, and short-period moving averages for quick signal generation.

Long-term investors benefit from weekly and monthly chart analysis, emphasizing trend-following indicators like long-period moving averages, MACD on higher timeframes, and major support/resistance levels. These longer-term perspectives help filter out market noise and focus on significant trend changes.

Multi-timeframe analysis combines both approaches, using longer timeframes to determine overall trend direction and shorter timeframes for precise entry and exit timing. This comprehensive approach maximizes the effectiveness of technical indicators across different trading styles.

Common Mistakes in Technical Analysis

Over Reliance on Single Indicators

Many novice traders make the mistake of relying too heavily on individual indicators rather than seeking confluence among multiple signals. Single indicators can generate numerous false signals, especially in ranging or choppy market conditions.

Successful Bitcoin price analysis requires patience and discipline to wait for multiple confirming signals before entering trades. This approach may result in fewer trading opportunities but typically produces higher success rates and better risk-adjusted returns. Understanding each indicator’s strengths and weaknesses helps traders select appropriate combinations for different market conditions and trading objectives.

Ignoring Market Context

Technical indicators must be interpreted within a proper market context, considering overall trend direction, volatility levels, and significant news events that might influence Bitcoin’s price action. Blindly following indicator signals without considering broader market conditions often leads to poor trading results.

Major cryptocurrency events, regulatory announcements, and macroeconomic factors can override technical signals, causing unexpected price movements that contradict indicator readings. Successful traders maintain awareness of both technical and fundamental factors affecting Bitcoin’s price.

Tools and Platforms for Technical Analysis

Modern trading platforms provide comprehensive technical analysis tools for Bitcoin price analysis, technical indicators signals. TradingView offers advanced charting capabilities with extensive indicator libraries and customizable alert systems.

Professional trading platforms like TradingStation, MetaTrader, and proprietary exchange platforms provide institutional-grade analysis tools with backtesting capabilities and automated signal generation. Mobile applications enable traders to monitor technical signals and manage positions while away from their primary trading setups, ensuring continuous market awareness and opportunity identification.

Also Read: Bitcoin Price Technical Analysis Complete Trading Guide for 2025 Success

Conclusion

Mastering Bitcoin price analysis, technical indicators signals requires dedication, practice, and continuous learning as market conditions evolve. The combination of traditional technical analysis principles with cryptocurrency-specific patterns creates opportunities for traders who invest time in developing their analytical skills.

Success in Bitcoin trading comes from understanding that technical indicators serve as tools to improve decision-making rather than guarantee profits. Risk management, emotional discipline, and consistent application of proven analytical techniques remain the foundation of profitable trading.

As the cryptocurrency market continues maturing, technical analysis becomes increasingly important for navigating volatile price movements and identifying profitable opportunities. Start implementing these Bitcoin price analysis technical indicators signals in your trading strategy today, and remember that continuous education and practice are key to long-term success in cryptocurrency markets.