Bitcoin Price Whale Movements Today How Large Transactions Shape Market

Bitcoin price whale movements today have become crucial for traders, investors, and anyone looking to navigate the volatile waters of digital assets. These large-scale Bitcoin holders, often controlling thousands or even tens of thousands of BTC, wield significant influence over market prices through their trading activities.

Bitcoin whale movements have taken on unprecedented importance in 2025, as institutional adoption continues to surge and retail investors seek to understand the forces driving price action. When a whale moves large amounts of Bitcoin, it can trigger cascading effects throughout the market, influencing everything from short-term price fluctuations to long-term market sentiment. Today’s whale activity provides valuable insights into market direction and investor psychology.

Understanding Bitcoin Whales and Their Market Impact

Bitcoin whales are entities holding substantial amounts of Bitcoin, typically defined as wallets containing 1,000 BTC or more. These heavyweight players include institutional investors, early Bitcoin adopters, mining companies, and cryptocurrency exchanges. Their actions send ripple effects throughout the entire cryptocurrency ecosystem.

The influence of whale movements extends far beyond simple supply and demand mechanics. When whales move large quantities of Bitcoin to exchanges, it often signals potential selling pressure, causing market anxiety and price volatility. Conversely, when whales move Bitcoin away from exchanges to cold storage, it typically indicates long-term holding intentions, often viewed as bullish by the market.

The Psychology Behind Whale Watching

Market participants closely monitor whale movements because these large holders often have access to information and resources that retail investors lack. Whale behavior can serve as a barometer for institutional sentiment and provide early indicators of potential market shifts. Understanding these patterns has become an essential skill for serious cryptocurrency investors.

How Bitcoin Price Whale Movements Today Are Reshaping 2025 Markets

The year 2025 has witnessed unprecedented whale activity in the Bitcoin market. The number of wallets holding over 1,000 Bitcoin (BTC) has climbed to 1,455 as of May 2025, marking a renewed wave of accumulation. This surge in whale addresses indicates growing institutional interest and long-term confidence in Bitcoin’s value proposition.

Recent data reveals fascinating trends in whale behavior. Bitcoin’s 2025 bull run is experiencing a significant third wave of profit-taking driven by new whales—entities holding at least 1,000 BTC—as the cryptocurrency surpassed $120,000 in late July. This profit-taking activity, totaling between $6-8 billion in realized gains, demonstrates the sophisticated trading strategies employed by large holders.

Dormant Whales Awakening

One of the most intriguing developments in 2025 has been the reactivation of long-dormant Bitcoin wallets. Recently, 3,422 Bitcoins, equivalent to $324 million, were transferred from a wallet that had been dormant for 12 years to a new address. These ancient whale movements capture significant attention as they represent some of the earliest Bitcoin accumulations, potentially dating back to the Satoshi Nakamoto era.

The awakening of dormant whales raises questions about their intentions. Are these movements preparation for massive sell-offs, or are early adopters simply modernizing their storage solutions? The cryptocurrency community watches these developments closely, as they could signal major market shifts.

Real Time Whale Tracking and Price Correlation

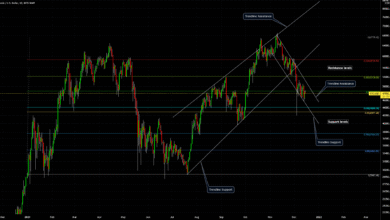

![]()

Modern blockchain analytics tools have revolutionized how we monitor whale activities. Platforms like Whale Alert, CryptoQuant, and Glassnode provide real-time tracking of large Bitcoin transactions, offering unprecedented transparency into whale behavior. These tools have become indispensable for traders and analysts seeking to understand market dynamics.

Exchange Flow Patterns

Whale movements to and from exchanges provide critical insights into market sentiment. CryptoQuant data show the highest BTC outflow from exchanges in two years, indicating a preference for long-term holding. This pattern suggests that whales are accumulating Bitcoin for extended periods rather than engaging in frequent trading.

The exchange whale ratio has become a key metric for predicting price movements. High ratios indicate increased whale activity on exchanges, potentially signaling upcoming volatility. Conversely, low ratios suggest whales are holding their positions, often correlating with price stability or gradual appreciation.

Major Whale Accumulation Strategies in 2025

Large Bitcoin holders employ sophisticated strategies that differ significantly from retail investor approaches. Whales often accumulate during market downturns, taking advantage of lower prices to increase their holdings. This counter-cyclical buying behavior helps stabilize markets and provides liquidity during volatile periods.

Dollar Cost Averaging at Scale

Many institutional whales employ large-scale dollar-cost averaging strategies, making regular purchases regardless of short-term price movements. This approach helps minimize the impact of their large trades on market prices while building substantial positions over time. The predictable nature of these purchases often provides support levels during market corrections.

Arbitrage and Market Making

Some whales engage in sophisticated arbitrage strategies, taking advantage of price differences between exchanges. These activities help maintain price efficiency across different trading platforms and contribute to overall market liquidity. Market-making whales provide buy and sell orders around current prices, earning spreads while reducing volatility.

The Relationship Between Whale Movements and Bitcoin Price Action

The correlation between whale movements and Bitcoin price action has become increasingly sophisticated in 2025. While large transactions don’t always immediately impact prices, they often precede significant market moves. Smart money often positions itself ahead of major announcements or market developments.

Leading Indicators vs. Lagging Indicators

Whale movements often serve as leading indicators, providing a warning of potential price movements. When multiple whales begin accumulating or distributing simultaneously, it frequently signals impending market shifts. However, distinguishing between routine wallet management and strategic positioning requires careful analysis.

Price movements can also influence whale behavior, creating feedback loops that amplify market trends. During bull markets, whale accumulation often accelerates as large holders seek to increase their exposure to rising prices. Conversely, bear markets may trigger distribution as whales take profits or reduce risk exposure.

Impact of Institutional Whales on Market Stability

The growing presence of institutional whales has fundamentally changed Bitcoin market dynamics. Unlike early individual whales who might make emotional trading decisions, institutional players typically follow systematic approaches based on portfolio theory and risk management principles.

Corporate Treasury Holdings

Major corporations holding Bitcoin in their treasuries represent a new class of whales with different motivations than traditional investors. These entities often have long-term holding horizons and sophisticated risk management frameworks. Their presence adds stability to the market while introducing new variables related to corporate financial strategies.

Companies like MicroStrategy have pioneered corporate Bitcoin adoption, demonstrating how traditional businesses can integrate cryptocurrency into their balance sheets. These corporate whales often announce their Bitcoin strategies publicly, providing transparency that helps markets adjust to their activities.

Regulatory Considerations and Whale Behavior

The evolving regulatory landscape significantly influences whale behavior in 2025. As governments worldwide develop clearer frameworks for cryptocurrency regulation, institutional whales adapt their strategies to ensure compliance while maximizing returns.

Compliance and Reporting Requirements

Large institutional holders must navigate complex compliance requirements that affect their trading strategies. Anti-money laundering regulations, tax reporting obligations, and fiduciary duties all influence how whales manage their Bitcoin holdings. These regulatory considerations often lead to more predictable and transparent whale behavior.

The increasing regulatory clarity has attracted new institutional whales who previously avoided cryptocurrency due to compliance concerns. This influx of regulated entities contributes to market maturity and long-term stability.

Geographic Distribution of Bitcoin Whales

Bitcoin whale distribution varies significantly across different geographic regions, influenced by local regulations, economic conditions, and cultural attitudes toward cryptocurrency. Understanding these regional patterns provides insights into global market dynamics and potential pressure points.

North American Institutional Presence

North American whales, particularly those in the United States, often represent institutional investors and corporations. These entities typically follow strict compliance protocols and have long-term investment horizons. Their presence contributes to market stability and provides a foundation for continued institutional adoption.

Asian Market Dynamics

Asian whales, particularly those in regions with favorable cryptocurrency regulations, often employ different strategies than their Western counterparts. These markets frequently show higher trading volumes and more active whale participation in daily market activities.

The Role of Mining Whales

Bitcoin mining operations represent a unique category of whales with specific characteristics and motivations. These entities regularly receive newly minted Bitcoin and must balance operational expenses with strategic holding decisions.

Mining Pool Concentrations

Large mining pools accumulate significant Bitcoin holdings through their operations. Their decisions about when to sell newly mined coins versus holding them for appreciation significantly impact market dynamics. Mining whales must consider electricity costs.

Equipment maintenance and market timing in their distribution strategies. The cyclical nature of mining rewards and the upcoming halving events create predictable patterns in mining whale behavior. Understanding these cycles helps predict potential supply pressures and accumulation periods.

Technology and Infrastructure Supporting Whale Activities

The infrastructure supporting whale activities has evolved dramatically, enabling more sophisticated trading strategies and risk management approaches. Advanced custody solutions, trading platforms, and analytical tools have made large-scale Bitcoin management more accessible and secure.

Custody Solutions and Security

Institutional-grade custody solutions have become crucial for whale operations. These platforms provide the security and compliance features necessary for managing large Bitcoin holdings while maintaining accessibility for trading activities. The evolution of custody technology continues to attract new institutional whales to the market.

Multi-signature wallets, hardware security modules, and distributed key management systems provide the robust security required for whale-sized holdings. These technological advances reduce the risks associated with large Bitcoin positions and enable more sophisticated investment strategies.

Future Implications of Whale Behavior Patterns

The patterns emerging from whale behavior in 2025 provide insights into Bitcoin’s future market structure. As institutional adoption continues, we can expect whale activities to become more systematic and predictable, potentially reducing overall market volatility.

Evolution Toward Traditional Asset Classes

As Bitcoin matures, whale behavior increasingly resembles that seen in traditional asset classes. This evolution suggests that Bitcoin markets are becoming more efficient and less susceptible to manipulation, which could accelerate mainstream adoption.

The professionalization of whale activities through institutional frameworks and regulatory compliance creates a more stable foundation for long-term market growth. This trend suggests that future whale movements may be less disruptive to overall market stability.

Also Read: Bitcoin Price Consolidation and Future Outlook

Conclusion

The landscape of bitcoin price whale movements today continues to evolve as 2025 progresses, with institutional adoption driving new patterns in large-holder behavior. From the reactivation of dormant wallets to sophisticated accumulation strategies, whales remain a dominant force in Bitcoin market dynamics. Understanding these movements provides crucial insights for anyone serious about cryptocurrency investing.

As regulatory frameworks mature and institutional infrastructure improves, we can expect whale activities to become increasingly systematic and transparent. This evolution benefits all market participants by creating more predictable and stable trading environments.

Stay informed about bitcoin price whale movements today by following reliable blockchain analytics platforms and incorporating whale activity analysis into your investment strategy. The cryptocurrency market’s future depends significantly on how these large holders navigate the evolving digital asset landscape.