Bitcoin Price Momentum Indicator Analysis Master Trading Signals & Market Trends (2025)

Understanding bitcoin price momentum indicator analysis has become crucial for traders and investors navigating the volatile cryptocurrency market in 2025. As Bitcoin continues to establish itself as a digital asset class, the ability to accurately interpret momentum indicators can mean the difference between profitable trades and significant losses. Bitcoin price momentum indicator analysis involves examining various technical tools that measure the rate of change in Bitcoin’s price movement, helping traders identify potential entry and exit points.

The cryptocurrency market’s 24/7 nature and extreme volatility make momentum analysis particularly valuable for Bitcoin trading. Unlike traditional markets, Bitcoin never sleeps, creating unique opportunities and challenges that require sophisticated analytical approaches. Through comprehensive bitcoin price momentum indicator analysis, traders can better understand market sentiment, identify trend reversals, and make more informed decisions about their cryptocurrency investments.

What is Bitcoin Price Momentum Indicator Analysis

Bitcoin price momentum indicator analysis refers to the systematic examination of technical indicators that measure the speed and strength of Bitcoin’s price movements over specific periods. These indicators help traders determine whether Bitcoin is experiencing bullish or bearish momentum and predict potential future price directions.

Momentum indicators work by comparing current price levels to historical prices, revealing whether buying or selling pressure is increasing or decreasing. This analysis is fundamental to technical analysis and forms the backbone of many successful trading strategies in the cryptocurrency space.

Key Components of Momentum Analysis

The foundation of effective bitcoin price momentum indicator analysis rests on several core components. First, price velocity measures how quickly Bitcoin’s price is changing over time. Second, momentum oscillators provide signals about overbought and oversold conditions. Third, trend strength indicators help determine the sustainability of current price movements.

Professional traders typically combine multiple momentum indicators to create a comprehensive view of market conditions. This multi-indicator approach reduces false signals and provides more reliable trading opportunities. The most successful bitcoin price momentum indicator analysis strategies incorporate both leading and lagging indicators to balance predictive power with confirmation signals.

Essential Bitcoin Momentum Indicators Every Trader Should Know

Relative Strength Index (RSI)

The Relative Strength Index stands as one of the most popular momentum oscillators in bitcoin price momentum indicator analysis. RSI measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions in Bitcoin’s price action. The indicator oscillates between 0 and 100, with readings above 70 typically indicating overbought conditions and readings below 30 suggesting oversold conditions.

For Bitcoin trading, RSI proves particularly valuable due to the cryptocurrency’s tendency toward extreme price movements. When RSI reaches extreme levels, it often signals potential reversal points, though traders should always confirm RSI signals with additional technical analysis tools.

Moving Average Convergence Divergence (MACD)

MACD represents another cornerstone of bitcoin price momentum indicator analysis, combining trend-following and momentum characteristics. This indicator consists of two moving averages and a histogram that displays the difference between them. When the MACD line crosses above the signal line, it generates a bullish signal, while crosses below the signal line indicate bearish momentum.

The MACD histogram provides additional insights into momentum strength, with expanding histograms indicating strengthening trends and contracting histograms suggesting weakening momentum. Bitcoin traders often use MACD divergences to identify potential trend reversals before they become apparent in price action.

Stochastic Oscillator

The Stochastic Oscillator compares Bitcoin’s closing price to its price range over a specific number of periods, making it an excellent tool for bitcoin price momentum indicator analysis. This indicator helps identify momentum shifts and potential reversal points by showing where the current price stands relative to recent trading ranges.

Like RSI, the Stochastic Oscillator ranges from 0 to 100, with readings above 80 indicating overbought conditions and readings below 20 suggesting oversold conditions. The indicator’s sensitivity makes it particularly useful for short-term Bitcoin trading strategies.

Advanced Momentum Analysis Techniques

Volume-Weighted Momentum Indicators

Sophisticated bitcoin price momentum indicator analysis incorporates volume data to provide more accurate signals. Volume-weighted indicators like the Volume Weighted Average Price (VWAP) and Money Flow Index (MFI) combine price and volume information to create more reliable momentum signals.

These indicators prove especially valuable in Bitcoin markets because volume often precedes significant price movements. High volume during momentum shifts typically indicates stronger, more sustainable trends than low-volume movements.

Momentum Divergences

Divergence analysis represents an advanced technique in bitcoin price momentum indicator analysis, where momentum indicators move in the opposite direction of price action. Bullish divergences occur when Bitcoin makes lower lows while momentum indicators make higher lows, suggesting potential upward reversals.

Bearish divergences happen when Bitcoin reaches higher highs while momentum indicators show lower highs, indicating possible downward price movements. These divergences often provide early warning signals for trend changes, making them valuable tools for experienced traders.

How to Interpret Bitcoin Momentum Signals

Identifying Trend Strength

Effective bitcoin price momentum indicator analysis requires understanding how to interpret momentum signals in the context of overall market trends. Strong upward momentum typically features rising momentum indicators accompanied by increasing volume and sustained price advances above key moving averages.

Conversely, weakening momentum often manifests as divergences between price and momentum indicators, decreasing volume during price advances, or momentum indicators failing to reach new extremes despite price making new highs or lows.

Signal Confirmation Strategies

Professional traders rarely base decisions on single momentum indicators. Instead, they use multiple confirmation techniques to validate signals from their bitcoin price momentum indicator analysis. Common confirmation methods include waiting for multiple indicators to align, requiring volume confirmation, and using price action patterns to support momentum signals.

Successful confirmation strategies also incorporate market context, considering factors like overall cryptocurrency market sentiment, Bitcoin’s position relative to major support and resistance levels, and broader macroeconomic conditions that might influence cryptocurrency prices.

Timeframe Analysis

Different timeframes provide varying perspectives in bitcoin price momentum indicator analysis. Short-term momentum indicators help with entry and exit timing, while longer-term momentum analysis reveals the underlying trend direction and strength.

Traders often use multiple time frame analysis, examining momentum indicators across various periods to create a comprehensive market view. This approach helps distinguish between temporary momentum shifts and significant trend changes.

Common Mistakes in Bitcoin Momentum Analysis

Over-Reliance on Single Indicators

One of the most frequent errors in bitcoin price momentum indicator analysis involves depending too heavily on individual indicators without considering broader market context. Single indicators can generate false signals, especially in Bitcoin’s volatile environment. Successful momentum analysis requires combining multiple indicators, confirming signals with price action, and considering market fundamentals that might influence Bitcoin’s price movements.

Ignoring Market Context

Another common mistake involves analyzing momentum indicators in isolation without considering Bitcoin’s broader market environment. Factors like regulatory news, institutional adoption, macroeconomic events, and overall cryptocurrency market sentiment significantly impact Bitcoin’s price momentum. Effective bitcoin price momentum indicator analysis always incorporates these external factors to provide more accurate market assessments and trading decisions.

Bitcoin Price Momentum Trading Strategies

Momentum Breakout Strategy

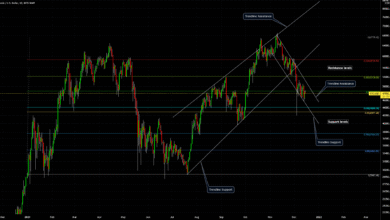

Momentum breakout strategies focus on identifying when Bitcoin breaks through significant resistance or support levels with strong momentum confirmation. These strategies typically combine price action analysis with momentum indicators to identify high-probability trading opportunities.

Successful momentum breakout trading requires careful attention to volume confirmation, momentum indicator alignment, and proper risk management techniques. Traders often use stop-losses below breakout levels and position sizing based on volatility measures.

Mean Reversion Strategy

Mean reversion strategies in bitcoin price momentum indicator analysis capitalize on momentum extremes by trading against prevailing trends when indicators suggest overbought or oversold conditions. These strategies work particularly well in ranging markets where Bitcoin oscillates between established support and resistance levels.

Effective mean reversion trading requires identifying reliable support and resistance levels, using momentum indicators to time entries, and implementing strict risk management rules to protect against trending markets that might extend beyond expected reversal points.

Trend Following with Momentum Confirmation

Trend following strategies use momentum indicators to confirm trend direction and strength rather than predict reversals. This approach to bitcoin price momentum indicator analysis focuses on riding established trends while using momentum indicators to optimize entry and exit timing. These strategies typically perform well during sustained bull or bear markets but require careful risk management during transitional periods when trends change direction.

Risk Management in Momentum Trading

Position Sizing

Proper position sizing represents a critical component of successful bitcoin price momentum indicator analysis and trading. Given Bitcoin’s volatility, traders must carefully calculate position sizes based on their risk tolerance, account size, and the specific momentum strategy being employed.

Common position sizing methods include fixed percentage risk per trade, volatility-adjusted position sizing, and momentum-based sizing that increases positions during strong momentum phases and reduces exposure during weak momentum periods.

Stop-Loss Strategies

Effective stop-loss placement requires understanding how momentum indicators behave during normal market fluctuations versus genuine trend changes. Stop-losses that are too tight might be triggered by normal volatility, while stops that are too wide might result in excessive losses. Many momentum traders use trailing stops that adjust based on momentum indicator readings, allowing profits to run during strong momentum phases while protecting against significant reversals.

Technology Tools for Bitcoin Momentum Analysis

Trading Platforms and Software

Modern bitcoin price momentum indicator analysis relies heavily on sophisticated trading platforms and analytical software. Popular platforms like TradingView, MetaTrader, and specialized cryptocurrency exchanges provide comprehensive momentum analysis tools.

These platforms offer customizable momentum indicators, backtesting capabilities, and alert systems that help traders monitor multiple momentum signals simultaneously. Advanced features include custom indicator development, automated trading capabilities, and integration with multiple cryptocurrency exchanges.

Automated Analysis Systems

Algorithmic trading systems increasingly incorporate bitcoin price momentum indicator analysis to execute trades automatically based on predefined momentum criteria. These systems can monitor multiple timeframes and indicators simultaneously, identifying trading opportunities that might be missed by manual analysis. However, automated systems require careful development, extensive backtesting, and ongoing monitoring to ensure they perform effectively in changing market conditions.

Mobile Analysis Tools

The 24/7 nature of Bitcoin markets necessitates mobile analysis capabilities for serious momentum traders. Mobile apps provide real-time momentum indicator updates, price alerts, and basic charting capabilities that enable traders to monitor positions and identify opportunities regardless of location. While mobile tools generally offer less comprehensive analysis capabilities than desktop platforms, they provide essential functionality for managing positions and responding to significant momentum shifts.

Future Developments in Momentum Analysis

Artificial Intelligence Integration

The integration of artificial intelligence and machine learning technologies promises to revolutionize bitcoin price momentum indicator analysis. AI systems can analyze vast amounts of market data, identify complex patterns, and adapt to changing market conditions more effectively than traditional analysis methods. These technologies might eventually provide more accurate momentum predictions and reduce false signals that currently challenge momentum traders.

Blockchain Analytics Integration

Emerging analytical tools combine traditional momentum analysis with blockchain data to provide more comprehensive market insights. These tools analyze on-chain metrics like transaction volume, wallet activity, and institutional flows alongside traditional momentum indicators. This integration provides a more complete picture of Bitcoin market dynamics and might improve the accuracy of momentum-based trading strategies.

Also Read: Bitcoin Price Support Resistance Levels Complete Trading Guide 2025

Conclusion

Mastering bitcoin price momentum indicator analysis requires dedication, practice, and continuous learning as market conditions evolve. The techniques and strategies outlined in this comprehensive guide provide a solid foundation for understanding and applying momentum analysis to Bitcoin trading. Success in cryptocurrency markets demands combining technical analysis skills with proper risk management and emotional discipline.

As Bitcoin continues maturing as an asset class, momentum analysis tools will likely become more sophisticated and accurate. Traders who develop strong bitcoin price momentum indicator analysis skills today position themselves for long-term success in the dynamic cryptocurrency markets.

Ready to enhance your Bitcoin trading skills? Start implementing these momentum analysis techniques today and join our community of successful cryptocurrency traders who rely on data-driven decisions for consistent profits.