Bitcoin Halving News and Predictions 2025 Latest Updates & Expert Analysis

The cryptocurrency world revolves around pivotal events that shape market dynamics, and few are as significant as the bitcoin halving news and predictions that captivate investors globally. The most recent Bitcoin halving occurred in April 2024, reducing mining rewards from 6.25 BTC to 3.125 BTC per block, marking another milestone in Bitcoin’s deflationary monetary policy.

As we analyze the aftermath and look toward future developments, understanding the implications of these programmed supply reductions becomes crucial for anyone invested in the cryptocurrency ecosystem. This comprehensive guide explores the latest bitcoin halving news and predictions, examining historical patterns, expert forecasts, and the potential market impact of upcoming halving events through 2028 and beyond.

Understanding Bitcoin Halving The Foundation of Scarcity

Bitcoin halving represents one of the most ingenious aspects of Satoshi Nakamoto’s original design. Every 210,000 blocks, approximately every four years, the network automatically reduces mining rewards by 50%. This mechanism ensures Bitcoin’s maximum supply remains capped at 21 million coins, creating programmed scarcity that distinguishes it from traditional fiat currencies.

The halving process operates independently of market conditions, human intervention, or external economic factors. It’s hardcoded into Bitcoin’s protocol, making it predictable yet profound in its economic implications. When miners receive fewer rewards for their computational work, the rate at which new bitcoins enter circulation decreases significantly.

This reduction in supply, assuming demand remains constant or increases, theoretically drives price appreciation. The concept mirrors precious metals like gold, where scarcity contributes to value preservation and potential growth over time.

The Mechanics Behind Bitcoin Halving Events

Each halving event occurs when the Bitcoin network processes 210,000 blocks. Initially, miners received 50 BTC per block when Bitcoin launched in 2009. The first halving in 2012 reduced this to 25 BTC, followed by 12.5 BTC in 2016, then 6.25 BTC in 2020, and most recently 3.125 BTC in April 2024.

The precise timing of halvings depends on the network’s hash rate and mining difficulty adjustments. While the target is roughly every four years, actual intervals can vary slightly based on how quickly miners process blocks. The next halving is projected for March or April 2028, when rewards will drop to 1.5625 BTC per block.

Bitcoin Halving News and Predictions Current Market Analysis

Following the April 2024 halving, the cryptocurrency market has demonstrated mixed reactions, highlighting the complexity of predicting short-term price movements despite long-term bullish fundamentals. Industry experts continue monitoring key metrics including mining profitability, network hash rate, and institutional adoption patterns.

Recent market analysis suggests that unlike previous halvings, the 2024 event occurred during a period of heightened institutional interest and regulatory clarity in major markets. This environment potentially accelerates the traditional post-halving price appreciation cycle that characterized previous events.

Mining companies have adapted to reduced rewards through improved efficiency, strategic positioning, and operational scaling. Many publicly traded miners expanded their operations in anticipation of the halving, betting on future price increases to maintain profitability despite lower block rewards.

Expert Price Predictions Following the 2024 Halving

Cryptocurrency analysts and institutional investors have published various bitcoin halving news and predictions following the recent event. Michael Novogratz of Galaxy Digital suggested Bitcoin could reach $150,000 by late 2024, citing growing institutional adoption and the supply shock created by halving.

Other prominent figures in the industry have presented even more bullish scenarios. Some predictions suggest Bitcoin could trade between $100,000 and $200,000 in the 12-24 months following the halving, based on historical patterns and increasing mainstream acceptance.

However, these predictions come with significant caveats. Market conditions in 2024 differ substantially from previous halving cycles, with factors including regulatory developments, macroeconomic conditions, and institutional participation creating new variables that could influence price trajectories.

Historical Bitcoin Halving Performance Lessons from the Past

Analyzing previous halving events provides valuable insights for current bitcoin halving news and predictions. Each event has demonstrated unique characteristics while following similar long-term patterns that inform current market expectations.

The 2012 Halving Bitcoin’s First Major Test

The first Bitcoin halving in November 2012 reduced rewards from 50 to 25 BTC per block. At the time, Bitcoin traded around $12, with limited mainstream awareness or institutional participation. The halving occurred during Bitcoin’s early adoption phase, when the network was primarily supported by enthusiasts and early adopters.

Following the 2012 halving, Bitcoin experienced significant price appreciation over the subsequent year, reaching over $1,000 by late 2013. This dramatic increase validated the theoretical framework linking supply reduction to price appreciation, establishing the foundation for future halving-related investment strategies.

The 2016 Halving Growing Mainstream Recognition

The second halving in July 2016 occurred as Bitcoin gained broader recognition and faced scaling debates within the community. Rewards dropped from 25 to 12.5 BTC per block, with Bitcoin trading around $650 at the time of the event.

The post-2016 halving period saw Bitcoin reach unprecedented heights, peaking near $20,000 in December 2017. This cycle demonstrated the potential for exponential growth following supply reductions, though it also highlighted the volatility and speculative nature of cryptocurrency markets.

The 2020 Halving Institutional Adoption Begins

The third halving in May 2020 coincided with unprecedented global monetary expansion and growing institutional interest in Bitcoin as a hedge against inflation. Rewards reduced from 12.5 to 6.25 BTC per block, with Bitcoin trading around $8,500.

The 2020-2021 cycle proved exceptional, with Bitcoin reaching an all-time high near $69,000 in November 2021. This period saw major corporations like Tesla and MicroStrategy add Bitcoin to their balance sheets, while institutional investment products gained significant traction.

The Next Bitcoin Halving 2028 Predictions and Preparations

Looking ahead to the next halving scheduled for March or April 2028, bitcoin halving news and predictions focus on several key factors that will shape the event’s impact. The mining reward will decrease from 3.125 to 1.5625 BTC per block, representing another 50% reduction in new supply issuance.

Industry experts predict that by 2028, Bitcoin will operate in a significantly different environment than previous halvings. Potential developments include clearer regulatory frameworks, broader institutional adoption, and potentially the introduction of central bank digital currencies that could influence Bitcoin’s role in the global financial system.

Mining Industry Evolution Toward 2028

The mining industry continues evolving to prepare for reduced rewards in 2028. Companies are investing in more efficient hardware, renewable energy sources, and strategic locations to maintain profitability. Some miners are diversifying into other cryptocurrencies or blockchain services to reduce dependence on Bitcoin block rewards.

Mining difficulty adjustments following each halving help maintain network security and processing times. The 2028 halving will test the network’s resilience and miners’ adaptability, particularly if Bitcoin’s price doesn’t appreciate sufficiently to offset reduced rewards.

Institutional and Regulatory Landscape Changes

By 2028, the regulatory environment for Bitcoin is expected to mature significantly. Countries worldwide are developing frameworks for cryptocurrency taxation, custody, and institutional investment. This regulatory clarity could attract additional institutional capital and reduce market volatility around halving events.

The potential introduction of Bitcoin exchange-traded funds (ETFs) in major markets could also influence halving dynamics. ETFs might smooth out price volatility by providing institutional investors with regulated access to Bitcoin exposure without direct custody requirements.

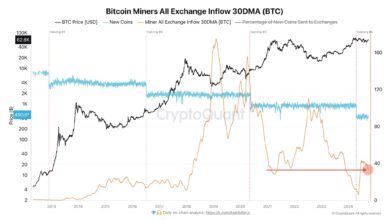

Technical Analysis On-Chain Metrics and Halving Indicators

Understanding bitcoin halving news and predictions requires analyzing on-chain metrics that provide insights into network health, investor behavior, and market sentiment. Key indicators include hash rate changes, mining difficulty adjustments, and long-term holder accumulation patterns.

The hash rate, representing total computational power securing the Bitcoin network, typically experiences short-term volatility following halvings as less efficient miners temporarily shut down operations. However, the network’s self-adjusting difficulty mechanism ensures consistent block production times regardless of hash rate fluctuations.

Stock-to-Flow Model and Halving Predictions

The stock-to-flow model, popularized by analyst PlanB, uses Bitcoin’s existing supply relative to new production to predict price movements. This model suggests that each halving significantly increases Bitcoin’s stock-to-flow ratio, potentially driving substantial price appreciation.

While the model has shown historical accuracy, critics argue that it oversimplifies complex market dynamics and may not account for changing adoption patterns or regulatory developments. Nevertheless, it remains a widely referenced framework for long-term Bitcoin price predictions.

Network Security and Hash Rate Implications

Each halving event tests Bitcoin’s network security model. As mining rewards decrease, the network relies increasingly on transaction fees to incentivize miners. This transition poses long-term questions about Bitcoin’s security model and fee market development.

Current transaction fee levels remain relatively low compared to block rewards, suggesting potential challenges for network security as mining rewards continue decreasing through future halvings. However, increased transaction volume and fee market evolution could address these concerns over time.

Global Economic Factors Influencing Bitcoin Halving Impact

The effectiveness of bitcoin halving news and predictions depends partially on broader economic conditions that influence cryptocurrency adoption and investment flows. Factors including inflation rates, monetary policy, and geopolitical tensions can amplify or diminish halving-related price movements.

Central bank policies regarding interest rates and money supply directly impact investor appetite for alternative assets like Bitcoin. Low interest rate environments typically favor Bitcoin investment, while rising rates may reduce speculative demand.

Inflation Hedge Narrative and Halving Events

Bitcoin’s narrative as an inflation hedge has gained prominence, particularly following the 2020 halving that coincided with significant monetary expansion. This positioning could influence future halving cycles if inflation concerns persist or central bank policies continue expanding money supplies.

The correlation between Bitcoin prices and traditional inflation hedges like gold provides insights into market perception of Bitcoin’s monetary properties. Stronger correlations might indicate growing acceptance of Bitcoin as a legitimate store of value.

Geopolitical Events and Safe Haven Demand

Geopolitical tensions and currency instability in various regions have historically driven demand for Bitcoin as a neutral, borderless asset. These factors could amplify halving-related price movements if international tensions coincide with future halving events. Countries experiencing currency devaluation or capital controls have shown increased Bitcoin adoption, creating additional demand that could interact with halving-induced supply constraints.

Investment Strategies Around Bitcoin Halving Events

Developing effective investment strategies requires understanding the timing, magnitude, and duration of halving-related price movements. Historical analysis suggests that Bitcoin typically experiences significant appreciation in the 12-18 months following each halving, though past performance doesn’t guarantee future results.

Dollar-cost averaging strategies around halving events have historically produced positive returns, though they require patience and discipline to execute effectively. This approach reduces timing risk while capitalizing on long-term appreciation trends.

Risk Management and Halving Volatility

Bitcoin’s volatility increases around halving events as markets process the supply reduction’s implications. Effective risk management strategies include position sizing, diversification, and stop-loss orders to protect against adverse price movements.

Institutional investors often employ more sophisticated strategies including derivatives, options, and structured products to gain Bitcoin exposure while managing downside risk. These tools may become more prevalent around future halving events.

Long-term Hodling vs. Trading Strategies

Long-term holding strategies have historically outperformed active trading around halving events, though they require significant patience and conviction. Traders attempting to time halving-related price movements face challenges including high volatility and unpredictable timing of price appreciation.

Successful halving-related trading strategies often combine technical analysis, on-chain metrics, and macroeconomic factors to identify optimal entry and exit points. However, these approaches require extensive knowledge and experience to execute effectively.

Bitcoin Halving Impact on Other Cryptocurrencies

Bitcoin halving events often influence the broader cryptocurrency market, creating opportunities and challenges for alternative cryptocurrencies. Understanding these dynamics helps investors position themselves for potential spillover effects from Bitcoin’s supply reductions.

Historically, major Bitcoin price movements following halvings have attracted attention to the entire cryptocurrency sector. This increased interest often benefits established altcoins and drives innovation in blockchain technology and cryptocurrency applications.

Mining Industry Diversification

As Bitcoin mining becomes less profitable following halvings, some miners diversify into other cryptocurrencies or blockchain services. This trend could influence the development and security of alternative blockchain networks. The migration of mining resources between cryptocurrencies based on profitability creates dynamic relationships between different blockchain networks and their respective token values.

Market Cap Dynamics and Altcoin Seasons

Bitcoin’s price appreciation following halvings often precedes periods of strong altcoin performance, known as “altcoin seasons.” Understanding these cycles helps investors allocate capital across different cryptocurrency categories. The timing and magnitude of altcoin seasons relative to Bitcoin halvings have varied across different cycles, influenced by factors including market maturity, regulatory developments, and technological innovations.

Future Outlook Beyond the 2028 Halving

Looking beyond the immediate 2028 halving, bitcoin halving news and predictions must consider the long-term implications of Bitcoin’s monetary policy. With each halving, mining rewards become increasingly small relative to Bitcoin’s total supply, potentially shifting the network’s economic model.

By 2032, the next scheduled halving will reduce mining rewards to approximately 0.78 BTC per block, making transaction fees an increasingly important component of miner revenue. This transition could fundamentally alter Bitcoin’s fee market and usage patterns.

Technology Developments and Layer 2 Solutions

The development of layer 2 solutions like the Lightning Network could influence future halving dynamics by reducing on-chain transaction demand and fee generation. These technologies might address Bitcoin’s scalability limitations.

While affecting the fee market that becomes increasingly important as mining rewards decrease. Integration of Bitcoin with traditional financial systems through layer 2 solutions could also influence adoption patterns and price volatility around future halving events.

Central Bank Digital Currencies and Bitcoin’s Role

The potential widespread adoption of central bank digital currencies (CBDCs) by 2028 and beyond could influence Bitcoin’s positioning in the global monetary system. CBDCs might compete with Bitcoin for certain use cases while potentially validating the concept of digital money. Bitcoin’s role as a neutral, decentralized alternative to government-controlled digital currencies could become more prominent as CBDCs develop, potentially influencing demand around future halving events.

Also Read: Bitcoin Price Surge Key Drivers Predictions & Future Outlook

Conclusion

The world of bitcoin halving news and predictions continues evolving as we transition from the recent 2024 event toward the anticipated 2028 halving. Understanding these programmed supply reductions and their historical impact provides valuable insights for cryptocurrency investors and enthusiasts.

While past halvings have demonstrated consistent patterns of long-term price appreciation, future events will unfold in increasingly complex market environments. Factors including institutional adoption, regulatory developments, and technological innovations will likely influence how markets respond to upcoming supply reductions.

Stay informed about the latest bitcoin halving news and predictions by following reputable cryptocurrency news sources and conducting thorough research before making investment decisions. Consider consulting with financial professionals who understand cryptocurrency markets and can help develop strategies appropriate for your risk tolerance and investment objectives.