Bitcoin ETFs institutional inflows surge price investment

As a leading player in the global financial scene, Bitcoin keeps changing. While Bitcoin’s Price has broken the $108,000 mark, Bitcoin Exchange-Traded Funds have recently experienced a fantastic spike with $2.75 billion weekly inflows. This milestone offers a great chance to investigate the causes of this sharp increase, the impact of institutional interest, the wider consequences for conventional finance, and the cryptocurrency market.

Bitcoin ETFs: A Safer Investment for Institutions

It has become a common portal for institutional investors looking to expose themselves to Bitcoin without actually owning the coin. These ETFs monitor Bitcoin’s price swings so that investors may purchase and sell shares on conventional stock markets. Unlike direct Bitcoin ownership, a Bitcoin ETF offers the ease of a controlled, liquid investment vehicle.

Bvehicles have long been considered a highly prospective alternative asset for many investors. But institutional money stayed on the outside due to major obstacles like questions about custody, security, and unclear rules. Bitcoin ETFs help to solve these issues by providing a safer, more controlled approach to investing in Bitcoin.

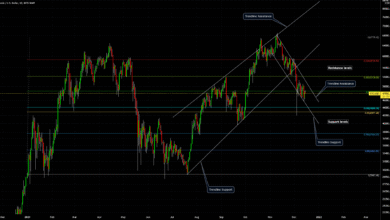

Bitcoin’s Record Surge: Drivers and Impact on ETFs

Recently exceeding the $108,000 barrier, Bitcoin’s price represents a fresh all-time high. Several elements have contributed to this rise in value: restricted supply of Bitcoin, rising inflation worries, and more institutional acceptance of Bitcoin. The restricted supply of Bitcoin (capped at 21 million coins) with rising demand generates a strong drive for price increases. Moreover, Bitcoin is increasingly seen as a counter against inflation, especially since central banks’ expansive monetary policies cause devaluation pressure for fiat currencies.

Bitcoin ETFs, which follow the cryptocurrency’s price swings, inevitably see their value climb as their price rises. One of the main causes of the explosive increase in ETF inflows is the relationship between Bitcoin price and the performance of Bitcoin ETFs. The $2.75 billion in weekly inflows indicate not only increasing investor demand but also rising hope for the asset’s future success.

Rising Institutional Interest in Bitcoin ETFs and Digital Assets

The significant surge in Bitcoin ETF inflows can be attributed to institutional investors’ growing interest. Hedge funds, pension funds, family offices, and prominent asset managers are beginning to deploy meaningful amounts of their portfolios to Bitcoin ETFs. Like digital gold, these investors see Bitcoin as a reasonable store of value and think it has potential as a hedge against economic unpredictability.

Approval of Bitcoin futures ETFs, which let investors gamble on the future price of Bitcoin, clearly shows this institutional change. More lately, there has been increasing expectation for approval of Bitcoin spot ETFs, which would immediately track Bitcoin’s price, making the cryptocurrency even more accessible to investors. The $2.75 billion weekly inflows capture institutional investors’ excitement and a more general trend of digital asset integration in conventional financial products. JPMorgan has also begun embracing Bitcoin through ETFs or providing financial services. The road to general acceptance lies through or services connected to cryptocurrencies A scoin: a—.asco inFsher digital asset products.

Rising Demand and Regulatory Developments in Bitcoin ETFs

The demand for Bitcoin ETFs has increased, along with the attention of regulatory authorities worldwide, mainly due to worries about market manipulation and investor protection. The Securities and Exchange Commission (SEC) in the United States has approached issuing cautiously. However, given the growing institutional interest and more transparent rules, Bitcoin spot ETFs should get approval shortly.

Regulatory developments are also in progress in other countries. The European Union’s Markets in Crypto-Assets (MiCA) rules are expected to offer more legal clarity for investments connected to cryptocurrencies throughout Europe. Since investors feel more confident about the long-term survival of these financial products, this legislation will probably propel even further expansion in Bitcoin.

Bitcoin ETFs: Institutional Growth Ahead

Looking forward, Bitcoin ETFs seem rather promising. The significant inflows indicate increasing faith in Bitcoin’s place as a mainstream financial tool. Moreover, the continuous infrastructure development of Bitcoin, including security and scalability enhancements, will probably help increase institutional interest.

The rising convergence of conventional finance with digital assets indicates that Bitcoin ETFs are here to stay. In the following years, more. More goods connected to Bitcoin and other cryptocurrencies appear, thus improving the availability of these digital assets to a wider spectrum of investors.

Conclusion

For institutional investors wanting to enter the realm of cryptocurrencies, Bitcoin ETFs are proving to be a necessary tool. With $2.75 billion in weekly inflows, the rise in investments has given more confidence in Bitcoin as a financial asset and further integration of digital assets into conventional finance. The price movement of Bitcoin above $108,000 has only heightened investor interest; hence, Bitcoin ETFs appeal to investors looking to profit on the asset’s rising path.

The future of seems exceptionally safe as more institutional participants enter the market and regulatory systems change. These financial instruments are not only bridging the divide between conventional banking and the cryptocurrency scene but also giving investors a means to join in Bitcoin’s expansion free from the complications of direct ownership. The $2.75 billion in weekly inflows is evidence of the increasing weight of Bitcoin ETFs and their part in determining the direction of world finance.