Bitcoin Short Squeeze Looms Key Factors Driving Price Surge

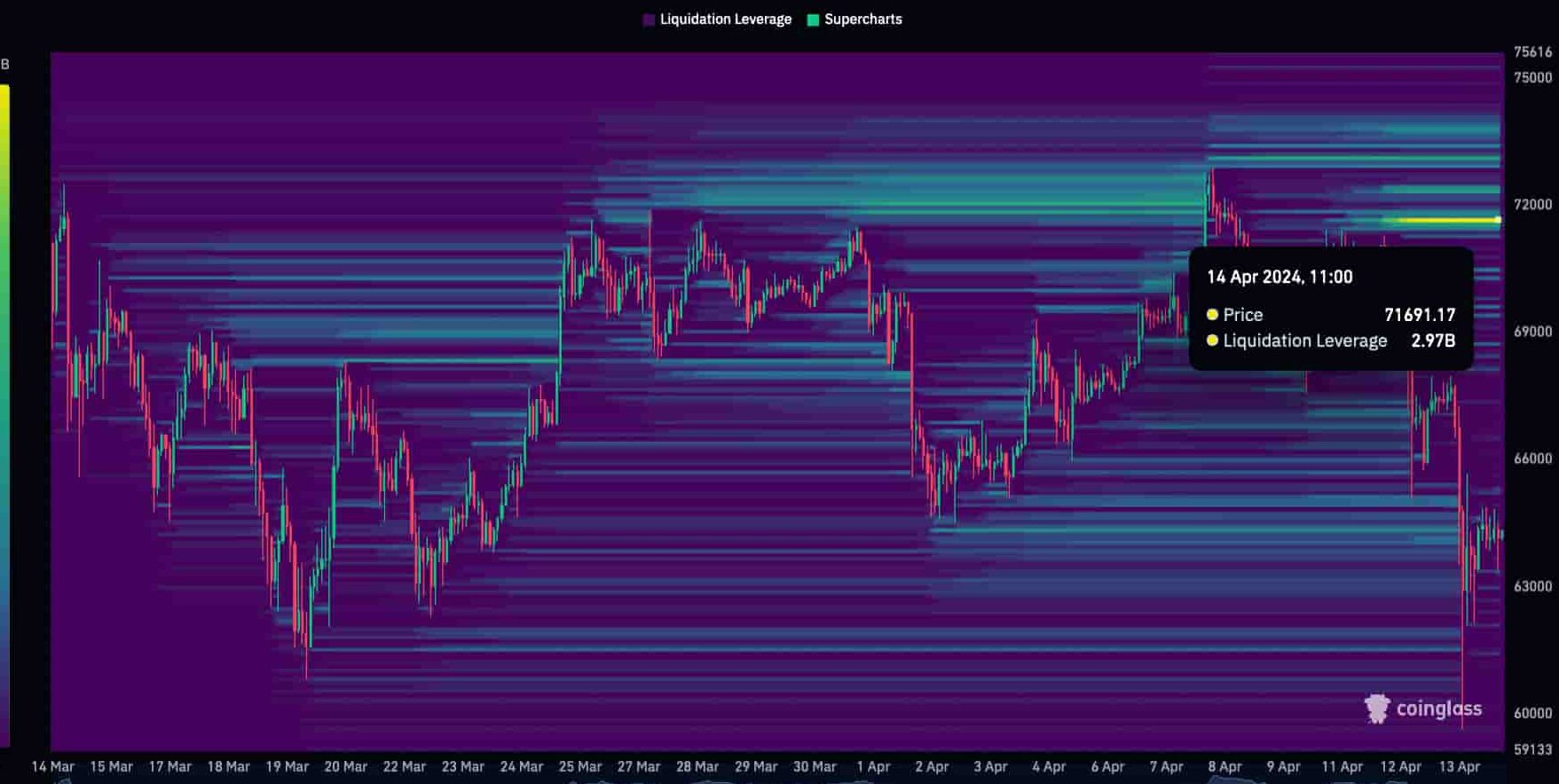

Once more, Bitcoin’s price path is catching attention as a significant short squeeze looms. Analysts warn that the bitcoin market might be about to have a notable upward breakout, given that over $3 billion in short positions are at risk. Should this event be triggered, it might send the price of Bitcoin skyrocketing, redefining short-term market dynamics and possibly reaching new all-time highs.

Bitcoin Short Squeeze

When traders short an asset, meaning they bet against it, they must quickly repurchase it to cover their positions as the price starts to climb. Often, dramatically, and randomly, this sudden buying demand drives the price higher. In the context of Bitcoin, where volatility is already significant and liquidity can vary by exchange, a short squeeze can generate dramatic price changes in relatively short intervals.

Right now, Bitcoin exposes around $3 billion worth of short holdings. Many of these fall into the $38,500 to $39,000 price range, which has been a significant barrier in recent weeks. Should Bitcoin exceed this level, cascade liquidations could occur, compelling short-sellers to buy back their positions en masse, driving an even more intense price rise.

Institutional Bitcoin Surge

Big investors, sometimes called “whales,” have significantly raised their Bitcoin holdings. Institutional wallets collected almost 60,000 BTC last week, signaling long-term optimism.

ETF Optimism: The possible approval of a Bitcoin Spot ETF in the United States keeps building expectations. Though several petitions remain pending with the Securities and Exchange Commission (SEC), there is great hope. Bloomberg analysts lately estimated the probability of ETF certification in 2025 to be more than 90%. Approved, such an ETF might open billions of fresh capital inflows, mainly from institutional and retirement accounts, once limited by direct crypto exposure.

On-chain measures and network health: Blockchain data indicates more wallet activity, higher transaction volume, and lower selling pressure from long-term investors. This suggests that most holders are not keen to sell at present prices, strengthening price support and promoting increasing momentum.

Bitcoin Surge and Squeeze

Should Bitcoin effectively set off a short squeeze above $39,000, experts predict it will quickly rise beyond $45,000 and maybe even $50,000 shortly. Should prices approach $60,000 or above, where a fresh wave of shorts is focused, a more dramatic squeeze could result. Recent on-chain data indicates that an extra $4 billion in shorts may be sold should the price approach roughly $90,000, a stretch objective for bulls.

Although $90,000 seems unrealistic in the current market environment, Bitcoin’s past of parabolic rallies following consolidation events makes such moves feasible, particularly when combined with a positive macroeconomic or legislative change.

Short Sellers’ Dilemma

Over the past year, short sellers have had intermittent success, particularly in times of macro uncertainty, increasing interest rates, and regulatory scrutiny. If the market improves, liquidations may be severe. When margin thresholds are violated, crypto exchanges close short positions, causing market buys that raise prices, perpetuating the pressure.

Technical indicators also suggest a clear bullish divergence these days. Recently out of a multi-week consolidation zone, Bitcoin broke free, and momentum oscillators like the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) point to bulls recovering control.

Bitcoin’s Bullish Outlook

External variables such as unexpected regulatory crackdowns, macroeconomic instability, or a sudden shift in investor sentiment could dampen the rally. Still, the stars seem to be aligning for a significant move upward, especially if a cascade of short liquidations plays out as forecasted.

Crypto Markets have historically thrived on volatility and momentum. With billions in short interest hanging in the balance, the coming days and weeks could mark a critical turning point. Whether you’re a seasoned investor or a curious observer, one thing is clear: Bitcoin’s next big move could be just around the corner—and it might come faster and harder than many expect.

Final thoughts

This paper offers a well-organized and cautiously hopeful view of the possibility of a notable increase in Bitcoin prices motivated by a forthcoming short squeeze. It underlines, among other things, the confluence of technical and fundamental bullish signals: substantial short interest close to essential price levels, increasing institutional accumulation, good ETF sentiment, and solid on-chain measurements. The situation described—where a breach above the $39,000 level may set off billions in liquidations—showcases how rapidly momentum might gather in crypto markets.

However, the work also gently balances the excitement with cautions of outside hazards, including macroeconomic changes and regulatory uncertainty, which have traditionally upset optimistic sets. The market will likely move erratically; hence, traders should be ready for positive and negative shocks.