Bitcoin’s Surge Beyond $100K – Institutional Support & Risks Ahead

The recent explosive climb of Bitcoin beyond the $100,000 level has energised the Bitcoin sector and confirmed long-standing optimistic forecasts. After years of volatility and regulatory uncertainty, several essential elements have supported a continuous advance.

Not everyone, meanwhile, is sure this ascent will go without a hitch. Futures traders remain cautious despite the positive signals, pointing to overleverage, more profit-taking, and hedging behavior as indicators of likely short-term volatility.

Institutional and Political Momentum

Renewal of institutional acceptance is one of the main drivers behind Bitcoin’s surge. Big companies like MicroStrategy have kept buying significant volumes of Bitcoin, supporting long-term belief in its function as a digital store of value. Several U.S.-listed Bitcoin ETFs have also been approved, increasing access for institutional and ordinary investors.

The political environment has also changed in favor. One significant change has been seen in the comeback to political relevance of former President Donald Trump and his strong advocacy of Cryptocurrency . For important regulatory posts such as the SEC, he has suggested pro-crypto leaders like Paul Atkins. This action has inspired hope that the United States might embrace a more innovative approach to digital assets, lowering some of the uncertainty that has dogged the sector.

Leverage Fuels Risk

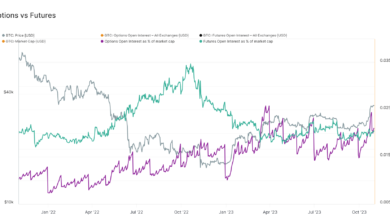

Despite these bullish developments, looking under the hood reveals why many futures traders remain cautious. The estimated leverage ratio in Bitcoin futures contracts is at its highest level in years, suggesting that traders are taking increasingly risky positions. High leverage can amplify gains in a rising market but also heightens the risk of liquidations if the price turns sharply against the majority position.

Additionally, open interest in futures markets is near record levels, with many traders heavily positioned in the expectation of further upside. When too much leverage accumulates in one direction, it can create a feedback loop: a minor price correction can trigger liquidations, leading to further price drops and more liquidations — a scenario seen during past bull cycles.

Bitcoin Correction Looms

Adding to the cautious tone, long-term holders have started to take profits. Over the past month, on-chain data has shown that more than $60 billion worth of Bitcoin has been distributed. While some of this activity reflects healthy market behavior, such as rebalancing portfolios, large-scale selling can exert significant downward pressure on prices.

Technical analysts have also warned that Bitcoin’s rally may be due for a pullback. Some experts predict a 20%–30 % correction could occur before Bitcoin continues its ascent. This would be consistent with historical trends, where several sharp retracements typically interrupt major bull runs. If Bitcoin were to drop back to the $75,000–$80,000 range, it might serve as a springboard for a more sustainable push beyond $100,000.

Bitcoin Options Caution

The market for Bitcoin options offers yet another sign of mounting apprehension. Data suggests traders are increasingly hedging their positions, particularly using out-of-the-money call and put spreads. These are meant to guard portfolios against abrupt downturn movements while capturing upside possibilities.

The declining call-put skew for forthcoming option expirations suggests that traders are no longer generally optimistic. Instead, they are paying more for puts, a clue that they are preparing for possible volatility. Though not always gloomy, these hedging actions imply that seasoned investors are setting themselves up for a more turbulent ride forward.

Macroeconomic Impact on Bitcoin

Another factor influencing Bitcoin’s momentum could be the macroeconomic state of affairs. Resiliently tracking the dollar’s value versus other big currencies, the U.S. dollar index (DXY) has maintained stability. Traditionally, a strong dollar causes a downplay of risk assets like Bitcoin. If the Fed raises interest rates for a long time, the currency may appreciate, and speculative markets like cryptocurrencies may lose liquidity.

Should inflation data deteriorate and rate cuts start, the atmosphere might become even more favorable for Bitcoin and other digital assets. Thus, investors attentively monitor forthcoming economic data and central bank direction for hints on the following market cycle phase.

Final thoughts

Solid fundamentals support Bitcoin’s historic rise above $100K, but the future is uncertain. At the same time, institutional support and regulatory clarity might offer long-term stability; in the near run, excessive leverage, more profit-taking, and a cautious attitude in derivatives markets could cause volatility.

The secret for traders and investors is to negotiate with confidence and prudence, using momentum while keeping vigilant for indicators of overheating. Though the stars may line up, the road to consistent highs will probably require endurance, discipline, and strategy.