Bitcoin Price Surge in 2025 Institutional Inflows and Price Surge

With its price now exceeding $91,000 for the first time in 2025, Bitcoin Price has experienced a notable rise in value. Citing a mix of solid on-chain indicators and a noteworthy increase in spot Bitcoin Exchange-Traded Fund (ETF) inflows, analysts are projecting a possible surge of 70% to 80%. The market is abuzz with this increasing trend, which is driving many to speculate on the direction of Bitcoin. Let’s examine the key elements behind this hope and the pricing that is pushing new highs.

Institutional Bitcoin Surge

One of the most significant trends in the Bitcoin market is institutional investment, primarily through U.S.-based spot Bitcoin Exchange-Traded Funds (ETFs). On April 21, these ETFs posted $381 million in net inflows, the biggest since January 30, indicating institutional interest. ETFs from BlackRock, Fidelity, and Bitwise, which have been adding Bitcoin holdings, are driving this spike.

Institutional liquidity is helping to stabilize Bitcoin’s price, which can be volatile due to retail demand. The confidence of significant financial players in it drives the price rise of Bitcoin. If ETF inflows continue, analysts expect Bitcoin to reach new highs, with some estimates putting it at $112,000.

Bitcoin’s Rising Fundamentals

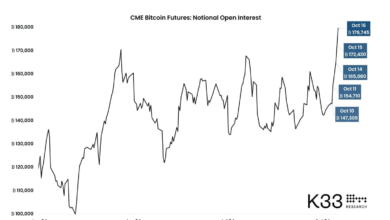

Apart from institutional inflows, on-chain data for Bitcoin is providing clear evidence of its increasing power. The futures open interest of Bitcoin is a key indicator to watch; it has surged by $2.4 billion in less than 36 hours. Often, before significant market swings, this increase signals increased investor confidence and a need for leveraged positions.

The hash rate of the Bitcoin network is another crucial on-chain metric since it has just set new all-time highs. This rise in hash rate indicates higher miner involvement, which is encouraging for the security and sustainability of the network. Active Bitcoin addresses and transaction volumes are rising, indicating a growing user base and Bitcoin acceptance. These solid fundamentals suggest that Bitcoin’s price surge is speculative and supported by increased network activity and institutional acceptance.

Retail Caution Institutional Confidence

Despite the bullish signs from institutional investors and strong on-chain data, retail investor participation in Bitcoin remains somewhat subdued. Data from CryptoQuant shows that buy volumes from retail investors—defined as transactions between $0 and $10,000—are still notably low, remaining under 0%. This suggests that smaller investors are taking a more cautious approach, possibly waiting for confirmation of a more sustained uptrend before investing.

However, history has shown that retail investors tend to enter the market when prices are on the rise, often after institutional players have already established their positions. Should retail interest start to pick up, it could catalyze further acceleration of Bitcoin’s price momentum. A surge in retail buying could help propel Bitcoin to the estimated 70% to 80% price increase that analysts are forecasting.

Bullish Bitcoin Outlook

Technical analysis also lends credence to the positive outlook for Bitcoin’s price. The cryptocurrency has recently broken through significant resistance levels, such as the $88,500 mark, establishing a pattern of higher highs. This kind of breakout is typically interpreted as a bullish signal, suggesting the initiation of a new uptrend.

Moreover, the Relative Strength Index (RSI), a key technical indicator that measures whether an asset is overbought or oversold, remains below the overbought threshold. This suggests that Bitcoin still has room to rise without facing the immediate risk of a correction. The combination of positive technical indicators and robust fundamental data further supports the notion that Bitcoin is well-positioned for substantial price appreciation shortly.

Bitcoin Price Outlook

While the outlook for Bitcoin is overwhelmingly positive, several factors could still influence its price in the coming months. Regulatory challenges remain a significant concern, particularly in major markets such as the United States and the European Union. Any changes in regulatory frameworks could impact institutional participation and, by extension, the broader Bitcoin Market. For instance, tighter regulations or restrictions on Bitcoin ETF offerings could dampen market sentiment.

Additionally, macroeconomic factors, such as fluctuations in inflation rates or changes in interest rates, could affect investor sentiment across all asset classes, including cryptocurrencies. Bitcoin has often been viewed as a hedge against inflation, but broader economic conditions may still influence its appeal relative to traditional financial assets.

Moreover, the inherent volatility of the cryptocurrency market means that Bitcoin could experience price corrections along the way. While the current momentum suggests higher prices, investors should remain vigilant for potential market shifts and consider the risks associated with short-term fluctuations.

Final thoughts

Bitcoin’s recent price surge, combined with strong on-chain indicators and significant institutional inflows, suggests a 70% to 80% growth in the coming months. This spike is due to Spot Bitcoin’s popularity, which has drawn data and favors the Foundation’s involvement.

However, involvement is still somewhat limited. If Bitcoin keeps on its rising path, the pattern might change. Technical indicators also show a positive picture; essentially, resistance levels have been reached, and there is room for further advancement. Investors must still be aware of specific hazards, including more general economic conditions that influence the market and legislative obstacles.

Currently trading at $93,6565, Bitcoin shows a 6.44% rise from yesterday. All eyes will be on whether Bitcoin can maintain its momentum and reach the expected price targets as the market absorbs the current influx of institutional money and improves its fundamentals.