Bitcoin Adoption by Public Companies Soars with 16% Q1 2025

The trend of publicly traded companies adopting Bitcoin will likely last until 2025. With a remarkable 16% rise in Bitcoin holdings in the first quarter alone, the coin is becoming rather popular in the corporate world. This rise highlights how progressively acceptable Bitcoin is as a strategic financial tool.

This shift reflects a broader change in how companies view cryptocurrencies, moving from a speculative investment to a vital part of their financial strategies. This article investigates the relevance of this 16% growth in Bitcoin holdings by public corporations, its consequences for the future of cryptocurrencies, and what this change suggests for the general adoption of digital currencies.

Bitcoin Adoption by Companies

With over eighty publicly traded firms already holding Bitcoin prices on their balance sheets, public company adoption of the Crypto Prices has surged in the first quarter of 2025. Reflecting a trend gathering steam over the past few years, this number shows a fantastic 16% increase in holdings over the previous quarter. Leading companies, including MicroStrategy, Tesla, and Block, have significant holdings. MicroStrategy alone has more than 120,000 BTC. When Tesla bought $1.5 billion worth of Bitcoin in 2021, it also made news since it indicated its conviction in the long-term value of the commodity.

Over the last few years, this tendency has been picking up speed. A few businesses had Bitcoin in 2020; by the end of Q1 2025, the count had surged to about 80. From roughly 200,000 BTC in early 2023 to more than 590,000 BTC by the end of 2024, the number of bitcoins owned by these businesses has also exploded. Estimates of an additional 50,000 to 70,000 BTC added to public companies collective holdings in just the first quarter of 2025 point to this consistent rise, emphasizing how much people believe Bitcoin to be a valuable and profitable asset.

Bitcoin Adoption Drivers

Several elements help explain the public companies’ increasing embrace of Bitcoin. The most important is the need for businesses to hedge against the devaluation of currencies and inflation. Bitcoin’s restricted number of 21 million coins sets it as a deflationary asset that can preserve wealth time, whereas conventional fiat currencies are under inflationary pressures. The fixed quantity of Bitcoin makes it a desirable store of value as central banks keep printing money. Businesses, especially those with lots of cash, are investigating how to protect their assets against the devaluation of fiat money.

A second important element is the growing institutional curiosity about cryptocurrencies. A major factor behind the increasing validity of the crypto market has been institutional investors. Research from 2024 shows that 83% of institutional investors have said they intend to expose themselves more to cryptocurrencies; several of them have urged the businesses they invest in to include Bitcoin in their treasury management approach. More public corporations are adding Bitcoin to their balance sheets in response to this increasing institutional demand for cryptocurrencies.

Furthermore, driving this trend is the emergence of crypto-based IPOs. Two of the biggest bitcoin exchanges, Gemini and Kraken, plan to go public in 2025. The success of IPOs would help legitimize the bitcoin market in the eyes of institutional investors and the general public and raise more money for the engaged companies. These events would help other public companies follow suit and indicate the mainstreaming of crypto prices.

Bitcoin in Finance

In corporate finance, the 16% increase in Bitcoin ownership among public firms in Q1 2025 represents a dramatic change in Bitcoin’s opinion. Bitcoin is now more often considered a strategic reserve rather than a speculative asset. Companies are investing in Bitcoin for its capacity to be a store of value and a hedge against macroeconomic volatility, in addition to its possible appreciation. Other businesses will probably follow suit as more enterprises embrace Bitcoin, fostering a positive feedback cycle that propels even more acceptance.

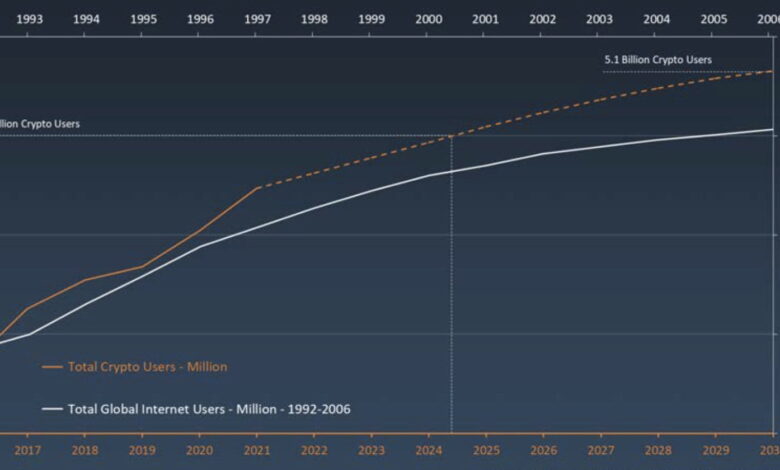

One of the most apparent consequences of this trend is Bitcoin’s increasing acceptance among more general financial professionals. Sometimes, people view Bitcoin as a side project associated with volatility and speculation. However, as more publicly traded businesses start to own Bitcoin, it is becoming increasingly evident that the phenomenon is not a fad but rather a long-term habit in the realm of business finance. This increasing acceptability could open the path for more institutional adoption and the ultimate general use of Bitcoin for regular transactions.

This acceptance, meanwhile, also carries fresh hazards and difficulties. Bitcoin is still very volatile, even if, over time, it has shown to be a fantastic store of wealth. In a brief period, the value of Bitcoin can vary greatly; hence, businesses that own significant quantities of Bitcoin could find themselves in severe financial peril should the market crash. As businesses include Bitcoin in their economic plans, they must control this risk closely.

Bitcoin Corporate Adoption

Looking forward, public company adoption of Bitcoin appears to be positive. The 16% increase in Q1 2025 is only the start; more businesses will probably keep including Bitcoin in their portfolios in the coming years. As the demand for Bitcoin increases, its acceptance will lead to a gradual stabilization of its price. As Bitcoin gains popularity as a mainstream asset class, its volatility may decrease, making it a more appealing choice for risk-averse businesses.

Apart from Bitcoin, other cryptocurrencies like Ethereum and several stablecoins could also gain more acceptance by public corporations. As blockchain technology develops, companies will seek ways to include digital assets in their operations and financial plans. The future of cryptocurrency in corporate finance is bright, as Bitcoin sets the standard and directs other businesses to follow.

Final thoughts

An important turning point in Bitcoin’s path toward general acceptance is the 16% increase in public company ownership in Q1 2025. Rising institutional interest, the demand for inflation hedging, and the emergence of crypto-based IPOs all help explain this surge.

As more businesses include Bitcoin in their financial plans, the currency will continue to become more credible and might finally change the direction of corporate finance. Even if obstacles still exist, public company adoption of Bitcoin points to a bright future for crypto and blockchain technologies in the financial sector.