Czech Republic Central Bank Governor Explores Bitcoin Investment

Czech Republic Central Bank: In a surprising turn of events, the Governor of the Czech Republic’s Central Bank has expressed interest in exploring Bitcoin as a potential investment avenue. Big Increase in Bitcoin Prices This marks a significant shift in the financial landscape of the country, where traditional banking systems have long dominated.

A New Era for Central Banking?

The Central Bank Governor, known for his pragmatic approach to economic policy, recently hinted at the possibility of integrating Bitcoin into the institution’s broader investment portfolio. Speaking at a financial conference in Prague, he acknowledged the growing importance of digital currencies in the global economy.

“While we remain cautious, the undeniable growth and adoption of cryptocurrencies, particularly Bitcoin, cannot be ignored. It’s time to evaluate its potential role in diversifying our reserves,” he stated.

Why Bitcoin?

Bitcoin, the world’s first decentralized cryptocurrency, has gained widespread acceptance as a store of value and a hedge against inflation. Its limited supply of 21 million coins and decentralized nature make it an attractive asset for institutions looking to reduce reliance on traditional financial systems.

For the Czech Republic, investing in Bitcoin could offer several benefits:

- Diversification: Including Bitcoin in the central bank’s reserves could help reduce risk by diversifying away from traditional assets like gold and foreign currencies.

- Inflation Hedge: Bitcoin’s scarcity makes it a potential hedge against inflation, a growing concern in the global economy.

- Technological Advancement: Embracing digital assets signals a forward-thinking approach, aligning the country with modern financial trends.

Challenges and Risks

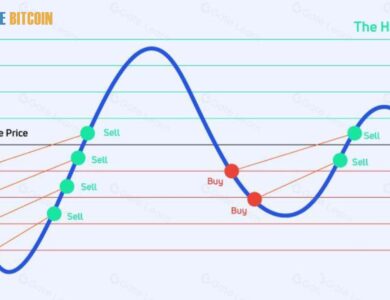

Despite the potential benefits, investing in Bitcoin comes with its challenges. Cryptocurrencies are notoriously volatile, with prices fluctuating dramatically within short periods. Additionally, regulatory uncertainties and cybersecurity concerns remain significant hurdles.

The Governor acknowledged these risks, emphasizing the need for thorough research and risk assessment before making any commitments. “Our priority is to ensure financial stability. Any decision regarding Bitcoin will be made cautiously and with the nation’s best interests in mind,” he assured.

Global Implications

If the Czech Republic’s Central Bank proceeds with Bitcoin investments, it will join a growing list of institutions and governments exploring cryptocurrency adoption. Countries like El Salvador have already embraced Bitcoin as legal tender, while others, including the United States, are exploring its regulatory framework.

Such a move could further legitimize Bitcoin as a mainstream financial asset and inspire other central banks to follow suit. It also highlights the evolving role of cryptocurrencies in reshaping traditional financial systems.

Conclusion

The Czech Republic’s potential foray into Bitcoin investment represents a bold step towards modernizing its financial strategy. While the decision is far from finalized, a central bank’s mere consideration of Bitcoin is a testament to its growing significance in the global economy.

As the world watches closely, the outcome of this exploration could set a precedent for other nations. Whether it’s a step towards embracing digital currencies or a cautious evaluation, one thing is clear: Bitcoin is no longer on the fringes of finance—it’s becoming a central topic of discussion in boardrooms worldwide.

[sp_easyaccordion id=”5558″]