Theoretical Supply of Bitcoin is 21 Million But What is the Actual Supply?

Bitcoin is 21 Million: Bitcoin, the first and most well-known cryptocurrency, is often praised for its limited supply. The number 21 million is deeply ingrained in Bitcoin’s narrative, representing the theoretical maximum number of bitcoins that can ever be mined. But while 21 million is the set limit, many wonder: how much Bitcoin is actually in circulation right now? And how close are we Can I Use Bitcoin for Everyday Purchases? to reach that total supply? In this article, we’ll explore the theoretical and actual supply of Bitcoin, how it works, and the factors that impact its availability.

The 21 Million Cap: The Theoretical Supply

The concept of a 21 million supply cap is built into Bitcoin’s core design by its pseudonymous creator, Satoshi Nakamoto. When Bitcoin was launched in 2009, Nakamoto’s vision was to create a digital currency with a fixed supply, unlike traditional fiat currencies that can be printed by governments at will. The 21 million cap was meant to emulate scarcity, making Bitcoin a deflationary asset that could potentially increase in value as demand grows over time.

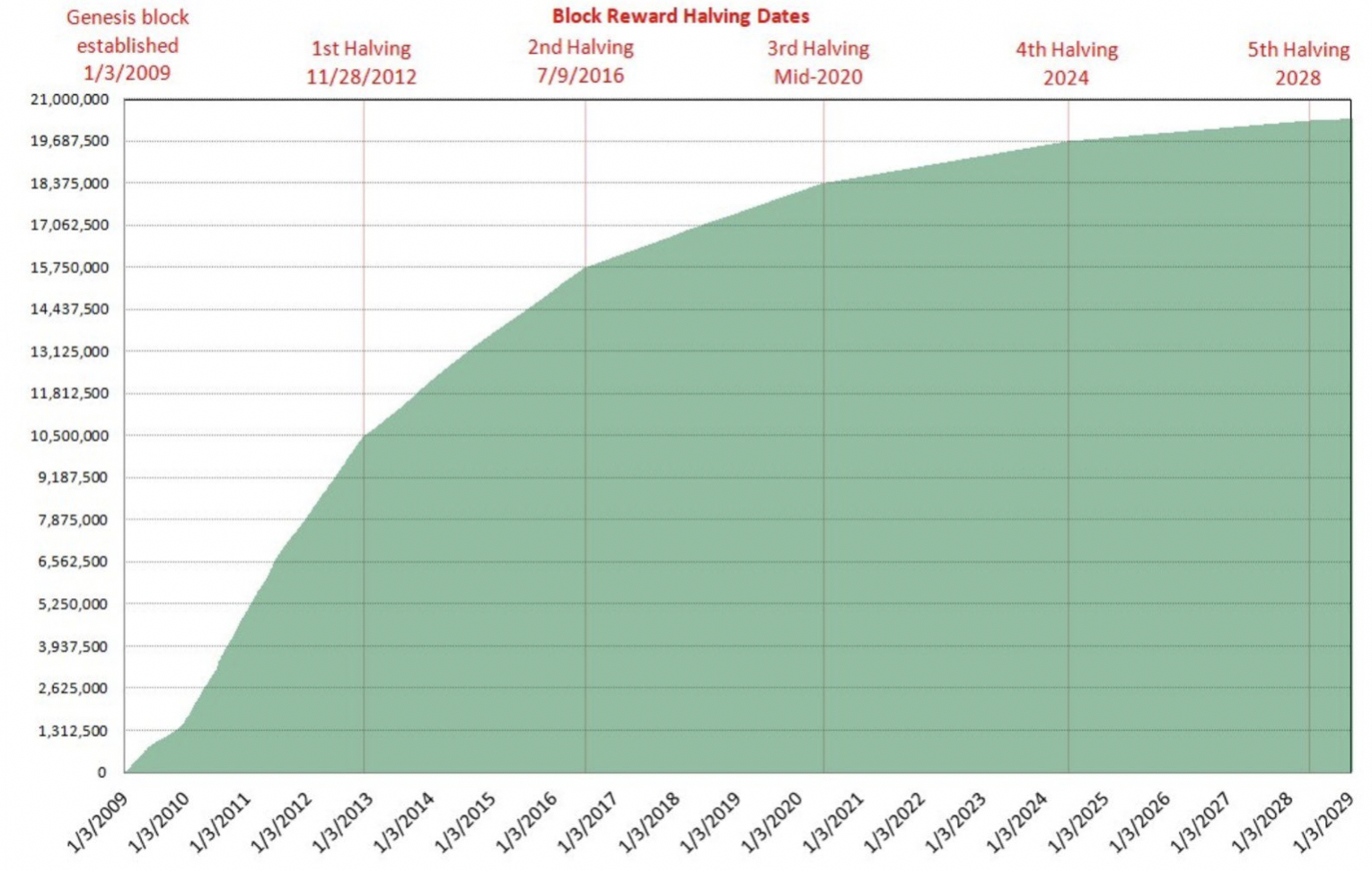

The supply of Bitcoin is governed by a process known as “mining.” New bitcoins are created as miners verify and add transactions to the blockchain, with the reward halving approximately every four years in an event known as the “halving.” When Bitcoin was first introduced, miners were rewarded 50 BTC per block mined. This reward has since halved three times, and as of 2024, the reward stands at 6.25 BTC per block.

This reward reduction continues until all 21 million bitcoins are mined, which is estimated to occur in the year 2140. The gradual reduction in rewards is designed to slow the rate at which new bitcoins are introduced into the market, ensuring a controlled and predictable supply.

The Actual Supply: What’s Circulating Today?

As of December 2024, more than 19.5 million bitcoins have already been mined. Leaving roughly 1.5 million bitcoins yet to be mined. So, what does this mean for the actual supply? While the total supply of Bitcoin is limited to 21 million. The number of bitcoins in circulation right now is not necessarily the same as the number that can be accessed or traded. Several factors affect the actual supply that is available in the market:

As of December 2024, more than 19.5 million bitcoins have already been mined. Leaving roughly 1.5 million bitcoins yet to be mined. So, what does this mean for the actual supply? While the total supply of Bitcoin is limited to 21 million. The number of bitcoins in circulation right now is not necessarily the same as the number that can be accessed or traded. Several factors affect the actual supply that is available in the market:

1. Lost Bitcoins

One of the most significant challenges in determining the actual supply of Bitcoin is the number of coins that have been permanently lost. Bitcoin transactions are irreversible, and if someone loses access to their private key or wallet, those coins are effectively lost forever. Early adopters of Bitcoin who may have forgotten about their holdings or lost access to their wallets are believed to account for a substantial portion of the lost coins.

Estimates suggest that around 3 million to 4 million bitcoins could be lost. This means that even though the theoretical supply is 21 million. The actual number of coins available for trade is much lower.

2. Holding: Long-Term Storage of Bitcoins

Many Bitcoin investors, known as “Hodlers,” choose to hold onto their bitcoins rather than spend or sell them. Bitcoin’s limited supply, coupled with its potential for price appreciation, encourages long-term holding. Some investors have not moved their bitcoins in years, contributing to a reduction in the available supply for active trading.

Data from blockchain analytics suggests that a significant portion of the total supply has not moved in over a year. This long-term holding behavior can artificially reduce the supply of bitcoins available in the market, which may increase demand for the remaining circulating coins.

3. Bitcoin on Exchanges

The amount of Bitcoin held on exchanges also plays a critical role in determining how much is actually available for trade. If a large amount of Bitcoin is stored on exchanges, it is available for buyers and sellers to exchange, increasing the market liquidity. However, many investors prefer to store their bitcoins in personal wallets, reducing the amount of Bitcoin held on exchanges and tightening the available supply even further.

4. Satoshis: The Smallest Unit of Bitcoin

It’s also important to consider Bitcoin’s smallest unit, known as a satoshi. One Bitcoin is divisible into 100 million satoshis, making Bitcoin highly granular. While the supply of full Bitcoins may seem limited. There is still a significant number of satoshis in circulation. In fact, because of Bitcoin’s divisibility, the theoretical and actual supply in terms of satoshis is far larger than the 21 million BTC cap might suggest.

How Close Are We to Reaching the 21 Million Cap?

While more than 19.5 million bitcoins have already been mined. The remaining 1.5 million bitcoins will take a long time to mine. Bitcoin’s mining difficulty adjusts over time. Making it progressively harder to mine new coins. As the block reward continues to halve every four years. The number of new bitcoins entering circulation will slow down, with the final Bitcoin expected to be mined in 2140.

Conclusion

The theoretical supply of Bitcoin is capped at 21 million. However the actual supply available for trade and circulation is much lower. Factors such as lost coins, and long-term holding. Reduced liquidity on exchanges all contribute to a supply that is far less than the full 21 million. While Bitcoin’s design ensures a predictable, finite supply. The actual number of bitcoins available at any given time is far from fixed and is influenced by several variables.

As Bitcoin continues to gain mainstream adoption more people recognize its value as a store of wealth. The scarcity of Bitcoin could drive up its demand. Further emphasizing the importance of understanding both its theoretical and actual supply.

[sp_easyaccordion id=”5234″]