Bitcoin Trading Explained: How to Maximize Your Profits

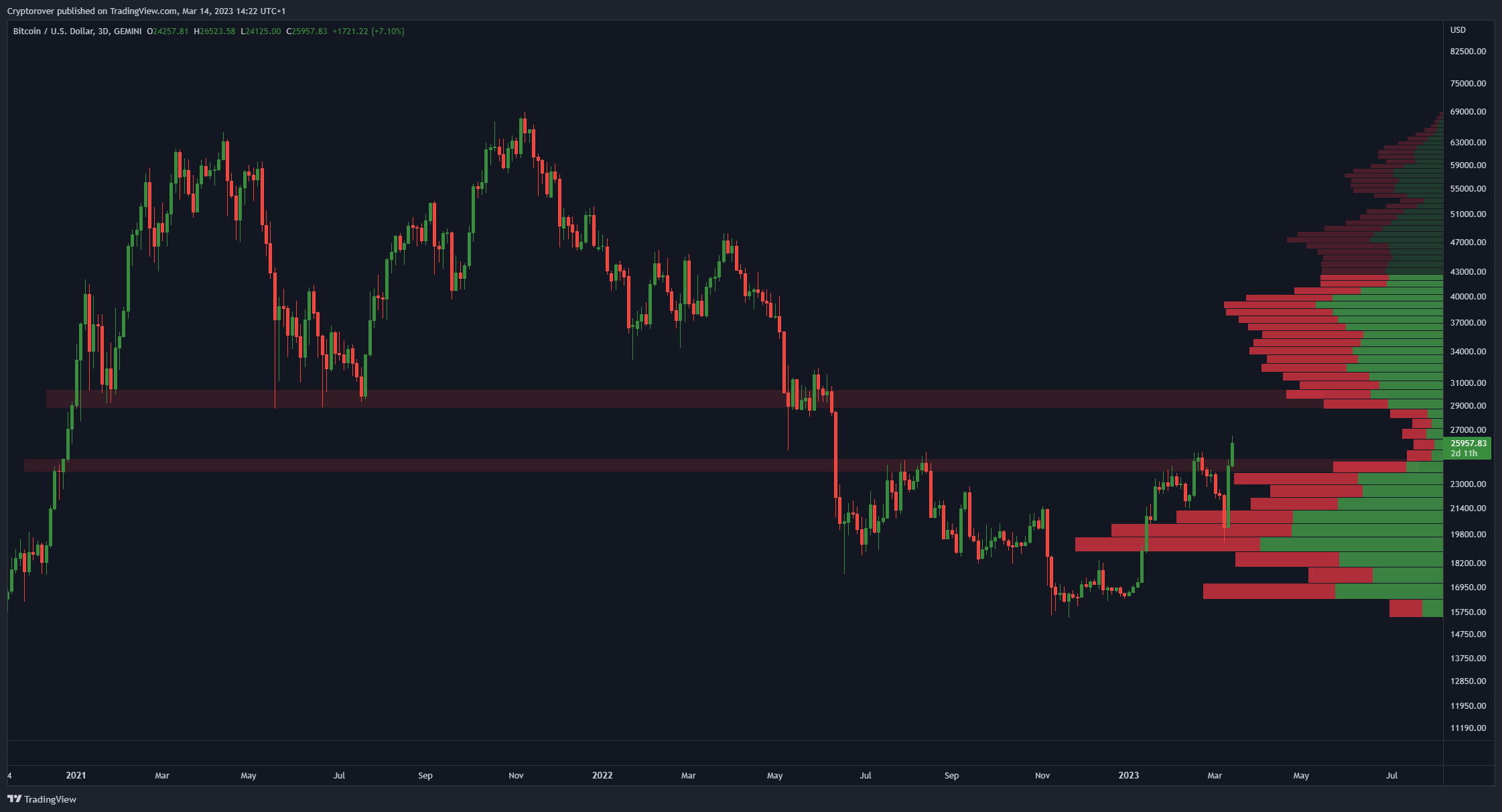

Bitcoin Trading Explained: Bitcoin trading has become a popular way to profit from the cryptocurrency market, offering exciting opportunities for both beginners and seasoned traders. However, trading Bitcoin successfully requires a deep understanding of market dynamics, ETH Price Surpasses $4,000: Is a New All-Time High in strategic planning, and a keen sense of risk management. In this article, we’ll break down the essentials of Bitcoin trading and share tips on how to maximize your profits.

What is Bitcoin Trading?

Bitcoin trading involves buying and selling Bitcoin to capitalize on its price movements. Unlike investing, which is a long-term approach, trading focuses on short-term gains through price fluctuations. Traders often use platforms called exchanges to execute trades, relying on analysis and strategies to predict market trends.

Bitcoin trading involves buying and selling Bitcoin to capitalize on its price movements. Unlike investing, which is a long-term approach, trading focuses on short-term gains through price fluctuations. Traders often use platforms called exchanges to execute trades, relying on analysis and strategies to predict market trends.

Steps to Start Bitcoin Trading

- Choose a Reliable Exchange

Select a reputable cryptocurrency exchange such as Binance, Coinbase, or Kraken. Look for features like low fees, high security, and user-friendly interfaces. - Create and Verify Your Account

Register on the exchange and complete the verification process to start trading. This step often includes submitting identification documents. - Fund Your Account

Deposit funds into your exchange wallet. You can typically deposit fiat currency (like USD or EUR) or other cryptocurrencies. - Learn the Basics of Trading

Familiarize yourself with trading terms like market orders, limit orders, stop-loss, and candlestick charts to better understand the trading process. - Start Trading Bitcoin

Use the funds in your account to buy and sell Bitcoin based on your analysis and market predictions.

Strategies to Maximize Bitcoin Trading Profits

- Learn Technical Analysis

Master tools and indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to analyze price trends and make informed trading decisions. - Follow Market News

Keep up with global and cryptocurrency-specific news that can impact Bitcoin’s price, such as regulatory announcements or technological upgrades. - Set Realistic Goals

Avoid greed by setting clear profit and loss targets for each trade. Use stop-loss orders to minimize potential losses. - Diversify Your Portfolio

Don’t put all your funds into Bitcoin. Consider diversifying into other cryptocurrencies or assets to reduce overall risk. - Use Leverage Cautiously

While leverage can amplify gains, it also increases the risk of significant losses. Use it only if you fully understand the mechanics and risks involved. - Practice Risk Management

Never trade more than you can afford to lose. A general rule is to risk only 1-2% of your trading capital on any single trade.

Common Mistakes to Avoid

- FOMO (Fear of Missing Out):

Jumping into trades without proper analysis can lead to significant losses. Avoid emotional trading. - Overtrading:

Trading too frequently can result in excessive fees and poor decision-making. Stick to a well-thought-out plan. - Ignoring Fees:

High transaction fees can eat into your profits. Opt for exchanges with competitive fee structures. - Neglecting Security:

Always enable two-factor authentication (2FA) and use secure wallets to protect your funds from cyber threats.

The Role of Automation in Bitcoin Trading

For those seeking a hands-off approach, trading bots can execute strategies automatically based on predefined rules. Popular bots like 3Commas or Cryptohopper can help you trade more efficiently, but remember that no bot can guarantee profits.

Conclusion

Bitcoin trading offers immense profit potential, but it comes with risks that require careful management. By educating yourself, adopting effective strategies, and maintaining discipline, you can navigate the volatile Bitcoin market and maximize your profits. Remember, success in trading doesn’t happen overnight—it’s a journey of learning, practice, and constant improvement.

[sp_easyaccordion id=”5101″]