Bitcoin Enters a Parabolic Phase That Could Last Long

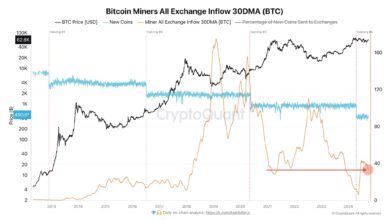

Bitcoin Enters a Parabolic Phase: Bitcoin Enters a Parabolic Phase: Bitcoin (BTC) has captured investor attention with double-digit gains over the past month. Popular analyst Rekt Capital suggests that Bitcoin is entering a parabolic phase, noting that this process is still in its early stages. Historical data indicates that while this phase may present significant opportunities, it also carries inherent risks Bitcoin DeFi is Blooming Why?.

A 300-Day Parabolic Phase Expected

Rekt Capital highlights that Bitcoin typically experiences a parabolic rise lasting around 300 days in each market cycle. According to the analyst, this current phase has just begun. Bitcoin’s current price stands at $97,465, with a staggering 45% increase over the past month. This robust performance reinforces Bitcoin’s appeal as an attractive asset for investors.

However, past cycles reveal varying price movement scenarios for the future. For instance, during the 2017 bull run, Bitcoin experienced an eight-week discovery phase, whereas the 2020-2021 cycle saw price discovery lasting just four weeks. These variations create uncertainty regarding the timing of potential corrections, keeping investors cautious.

Ethereum (ETH) Shows Bullish Momentum

Bitcoin isn’t the only cryptocurrency drawing attention. Ethereum (ETH) is also exhibiting bullish behavior. ETH recently broke out of a short-term bull flag formation and is moving toward new targets. Rekt Capital forecasts that Ethereum could reach the $3,700 resistance level. Currently priced at $3,346, Ethereum has recorded a 28% increase in the past month.

Bitcoin isn’t the only cryptocurrency drawing attention. Ethereum (ETH) is also exhibiting bullish behavior. ETH recently broke out of a short-term bull flag formation and is moving toward new targets. Rekt Capital forecasts that Ethereum could reach the $3,700 resistance level. Currently priced at $3,346, Ethereum has recorded a 28% increase in the past month.

You May Also Read: Trump’s Shift on Bitcoin Implications for 2024

Timing the Market: Opportunities and Challenges

Rekt Capital also warns that Bitcoin’s peak could arrive unexpectedly, adding an element of unpredictability to the market. This outlook has generated excitement among investors while encouraging a cautious approach to timing the market. Analysts agree that sudden and significant changes in market trends remain a constant possibility.

Navigating a Market Full of Opportunities and Risks

For cryptocurrency investors, this phase offers both opportunities and risks, underscoring the importance of strategic decision-making. As digital assets continue to influence traditional financial systems, the value of accurate data analysis has never been greater. The current market trends emphasize the dynamic nature of the crypto space, making it essential for investors to remain vigilant and adaptable in their strategies Scope Bitcoin – Secure Your Wealth with Bitcoin.

Conclusion

Bitcoin’s entry into a parabolic phase signals a period of exciting potential and volatility in the cryptocurrency market. With historical patterns suggesting opportunities for significant gains, this phase also carries the risk of sudden corrections. Rekt Capital’s insights emphasize the importance of strategic planning and cautious timing for investors looking to capitalize on these trends.

[sp_easyaccordion id=”4820″]