Bitcoin Market Analysis: A Look at Trends, Risks, and Future Outlook

Bitcoin Market Analysis: Bitcoin (BTC) is still the most important cryptocurrency as of September 2024, and its price and market behavior will continue to dictate the future of the whole digital asset ecosystem. Bitcoin’s decentralized character, together with its strong institutional support and expanding worldwide usage, has allowed it to remain resilient and dominant in the face of greater competition from other blockchain technologies. The analysis dissects Bitcoin’s current status, its price trends, investor mindset, risks, and possible future results.

Market Overview

Bitcoin’s price has been very volatile in 2024, ranging between $25,000 and $35,000 on a recurring basis due to both external market forces and internal market happenings. Price fluctuations between 2022 and 2023 caused Bitcoin to experience a period of consolidation, which is reflected in its current price of roughly $30,000.

In 2024, Bitcoin’s value has remained mostly unchanged despite worries about rising prices, interest rates, and the state of the global economy. Bitcoin seems to have passed its most volatile period, and now market players consider it more as a hedge against more conventional market dangers.

Institutional Interest Continues

Many view Bitcoin as “digital gold” with enormous long-term growth potential, and it is being increasingly accepted as a valid asset class by institutional investors. While this change was already noticeable in early 2020, it took shape in the following years. In 2024, many major banks have included Bitcoin-related assets in their portfolios. These include JPMorgan, BlackRock, and Fidelity. Both individual and institutional investors now have easier access to Bitcoin thanks to the launch of Bitcoin ETFs (Exchange-Traded Funds) in several countries.

Thanks to these institutional backings, the market now feels more stable. However, some are worried about how much centralization it would bring to an otherwise decentralized market. When powerful institutions have the power to affect major market movements, the question of whether this influence will cause price manipulation or distortion emerges.

Key Market Trends

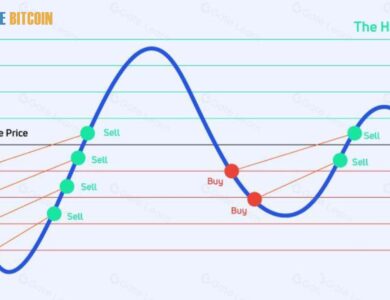

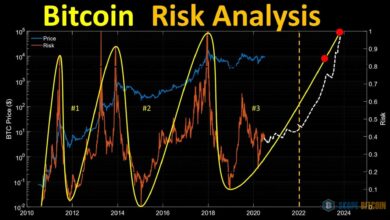

Bitcoin Halving Event 2024

In April 2024, a halving event will likely occur that will significantly impact Bitcoin’s price and market outlook. Halving events happen every four years and reduce the incentive that Bitcoin miners earn for confirming transactions. As a result, the amount of new Bitcoin that enters circulation is effectively cut in half. Although the precise time and size of these movements might vary, substantial price rises have historically accompanied halving occurrences. This is because lower supply drives up demand.

According to many market watchers, the 2024 halving will follow the same pattern as earlier, which sparked huge bull runs within a year or two. However, market dynamics may change as Bitcoin ages, which might result in a more muted post-halving bounce than in past cycles.

Macroeconomic Environment and Bitcoin’s Role as a Hedge

Many in 2024 saw Bitcoin as a way to protect themselves against inflation and political unrest. Many investors have flocked to Bitcoin as a haven amid persistent worries about inflation and a possible worldwide economic downturn. Those looking to diversify their portfolios find Bitcoin an enticing alternative even though it has not yet shown to be as stable as conventional safe-haven commodities like gold.

Central banks’ monetary policy decisions, especially those in the United States and Europe, will continue to affect the price of Bitcoin. These institutions are still trying to manage inflation. Due to investors’ preference for less risky assets, Bitcoin’s rising momentum might be slowed down if interest rates stay high or climb much higher. However, if inflation or economic downturns persist, further wealth may be drawn to Bitcoin as an alternative investment.

Lightning Network and Scalability Solutions

The scalability of Bitcoin, particularly about processing times and transaction fees, has been a major issue for quite some time. Significant adoption of the Lightning Network, a Bitcoin layer-2 scaling solution, has occurred in 2024. This network enables quicker and cheaper transactions by executing transactions off-chain and settling final amounts on the Bitcoin blockchain.

Merchants and individuals worldwide are now using Bitcoin for microtransactions and international payments because of the Lightning Network’s increased capacity, which has made the cryptocurrency more usable as a means of exchange. If this pattern persists, Bitcoin may gain even more acceptance as a medium of exchange and a store of wealth.

Regulatory Developments

In the Bitcoin market, regulation is still a double-edged sword. Although some nations are taking different approaches, they are stepping up their attempts to regulate Bitcoin and other cryptocurrencies in 2024. With new regulations mandating more openness from cryptocurrency issuers and exchanges, the United States Securities and Exchange Commission (SEC) has assumed a more proactive role.

On the one hand, more institutional engagement might result from increased investor trust if regulatory frameworks were more transparent. Conversely, market uncertainty might result from regulations that are too stringent, which hinder innovation and growth in the industry. In addition, although El Salvador and other countries have recognized Bitcoin as legal money, countries like India and China have maintained tight regulations on its usage and trade.

Risks to Consider

Market Volatility

Although 2024 has seen more consistent price changes for Bitcoin than years past, market volatility is still a basic aspect of the industry. Price changes might happen quickly if there are unexpected changes in the macroeconomy, new regulations, or technological advances. In the days leading up to big events, like the Bitcoin halving or important governmental pronouncements, investors should brace themselves for periods of extreme volatility.

Competition from Altcoins

Ethereum (ETH) has made great progress with its proof-of-stake shift, and younger contenders like Solana and Avalanche are posing a growing threat to Bitcoin’s position as the leading cryptocurrency. These alternatives to Bitcoin could entice developers and consumers with quicker transaction speeds and more versatile smart contract features.

However, Bitcoin’s first-mover advantage and strong brand recognition continue to give it a leading position in the market. Nevertheless, the rise of these alternatives could limit Bitcoin’s growth if it fails to evolve in response to technological advancements.

Environmental Concerns

As the globe shifts its attention to sustainability, Bitcoin’s energy-intensive proof-of-work consensus process has continued to be a source of concern. Although there has been less discussion about energy in 2024 than in previous years, it is still a concern for Bitcoin’s future growth, particularly with the rise of greener blockchain options.

Future Outlook

The upward trend in Bitcoin’s acceptance and institutional engagement will persist until the latter half of 2024. The approaching halving event might trigger a fresh wave of price appreciation, so it will be important to keep an eye on it. The future of Bitcoin’s use and attractiveness as a medium of exchange and store of value will be heavily influenced by advancements in the Lightning Network and the clarity of regulations.

Nevertheless, obstacles persist. For Bitcoin to continue to dominate, it will be necessary to overcome issues like its volatility, energy usage, and competition from alternative blockchain technologies. In addition, the market will still be influenced by global economic factors such as interest rates and inflation swings.

In Summary

The market for Bitcoin in 2024 is optimistic yet cautious. It has a strong basis for development thanks to its stability compared to prior years, increasing institutional support, and ongoing innovation in scaling solutions. With the impending halving event, governmental constraints, and competition from newer blockchain technology, investors should stay vigilant and aware of the dangers and difficulties. Bitcoin is still a major player in the financial sector, but it must change to keep growing.