Bitcoin Risk Analysis: Complexities of the World’s Leading Crypto

Bitcoin Risk Analysis: Bitcoin has been at the forefront of the cryptocurrency industry since its launch in 2009. It changed the financial world for the better since it was the first decentralized digital money. Bitcoin, however, is not risk-free, even though it may provide enormous profits. Investors, corporations, and governments are all worried about its price volatility, regulatory ambiguity, and vulnerability to cybercrime. Bitcoin is a highly risky investment, and this essay dives into a thorough risk analysis of the cryptocurrency to explain why.

Price Volatility

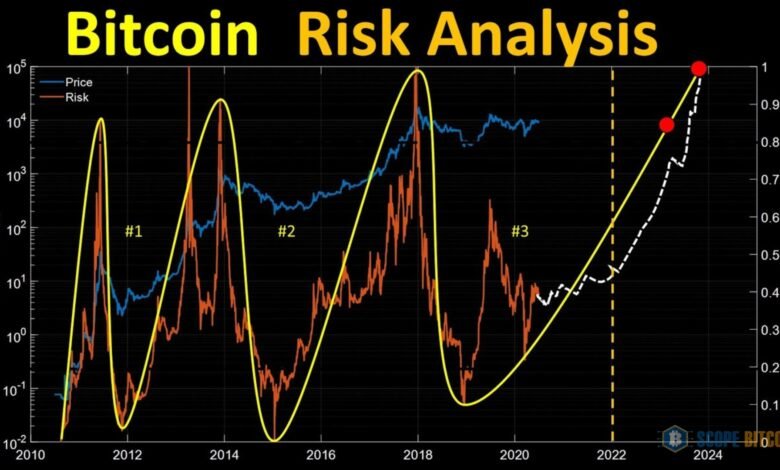

Bitcoin is notorious for its extreme price volatility. Since its value is not backed by any physical asset or guaranteed by a central authority, its price is subject to market forces, speculation, and news cycles. Historically, Bitcoin’s price has experienced significant fluctuations, often within short periods, which can result in massive gains and devastating losses for investors.

Examples

2017 Bitcoin surged to nearly $20,000 per coin, only to crash to around $3,000 by early 2018. Similarly, in 2021, Bitcoin reached an all-time high of nearly $69,000 before plummeting to less than $30,000 just a few months later. These wild price swings make Bitcoin appealing to speculators and pose substantial risks for long-term investors.

Causes of Volatility

Several factors drive Bitcoin’s price volatility:

- Market Sentiment: News and social media influence Bitcoin’s price. Positive news, such as institutional adoption or regulatory clarity, can cause price spikes, while negative reports about security breaches or potential bans lead to sell-offs.

- Liquidity: Compared to traditional assets, Bitcoin markets have relatively low liquidity. Large trades can disproportionately affect the price, contributing to volatility.

- Macroeconomic Conditions: Bitcoin’s price can be influenced by global economic factors, including inflation concerns, interest rate changes, or geopolitical events, as investors seek alternative stores of value.

Regulatory Risks

Regulatory uncertainty is one of the most significant risks associated with Bitcoin. As governments worldwide grapple with how to handle cryptocurrency, laws, and regulations surrounding its use, taxation, and trading, continue to evolve. The lack of clear, uniform guidelines can have major implications for the market.

Key Regulatory Concerns

- Legality: In some countries, Bitcoin is illegal or heavily restricted. Nations like China have banned crypto mining and trading activities, while others, like India, have fluctuated between proposing harsh regulations and more lenient policies.

- Taxation and Compliance: Governments increasingly require cryptocurrency holders to report their transactions for tax purposes. Failure to comply with tax regulations could lead to penalties for investors and affect market behavior.

- Future Regulation: There is always the risk that governments may impose stricter regulations on Bitcoin, potentially limiting its utility or making it less attractive to hold or trade. For example, central bank digital currencies (CBDCs) may compete with or overshadow Bitcoin, leading to potential regulatory restrictions on decentralized cryptocurrencies.

Regulatory Impacts on Price

Whenever a government signals impending regulation, Bitcoin’s price typically reacts strongly. For example, when the U.S. Securities and Exchange Commission (SEC) rejected Bitcoin exchange-traded fund (ETF) applications, the market often saw a price drop. Conversely, news of regulatory acceptance or progressive policy moves has historically spurred price rallies.

Cybersecurity Risks

Bitcoin’s decentralized nature makes it immune to many traditional forms of financial fraud, but it is still vulnerable to cybersecurity threats. Hackers target cryptocurrency exchanges, wallets, and individual investors, leading to the loss of millions of dollars worth of Bitcoin.

Key Threats

- Exchange Hacks: Cryptocurrency exchanges, where users buy and sell Bitcoin, are frequent targets of cyberattacks. Some of the most famous cases include the 2014 Mt. Gox hack, where over $450 million worth of Bitcoin was stolen, and the 2021 breach of the BitMart exchange, resulting in a loss of around $150 million.

- Phishing Scams: Hackers often use phishing attacks to access investors’ private keys, essential for accessing Bitcoin wallets. If a private key is compromised, the Bitcoin associated with that wallet can be stolen and is usually irretrievable.

- Smart Contract Vulnerabilities: While Bitcoin does not use smart contracts, many decentralized finance (DeFi) projects built on other blockchains use Bitcoin-backed assets. Flaws in these smart contracts can lead to exploits that drain funds from decentralized platforms.

Mitigation Strategies:

Investors can protect themselves using hardware wallets (cold storage) instead of keeping large amounts of Bitcoin on exchanges. Multi-signature wallets, where multiple transaction approvals are required, can also enhance security. Additionally, regular audits of smart contracts and exchanges can reduce vulnerabilities.

Technological Risks

Bitcoin is built on blockchain technology, and while this technology is revolutionary, it is still evolving. Any vulnerabilities or limitations in Bitcoin’s underlying infrastructure pose significant risks to its long-term viability.

Scalability Issues

Bitcoin’s blockchain, while secure, faces scalability problems. The network can handle only a limited number of transactions per second, which results in slower transaction speeds and higher fees during times of high demand. This has led to the development of off-chain solutions like the Lightning Network, which aims to improve transaction efficiency. However, the widespread adoption of these solutions remains uncertain.

51% Attack Risk

A “51% attack”—where one organization controls more than half of Bitcoin’s mining power—is theoretically possible but unlikely owing to its large network. This would enable blockchain manipulation and double-spending assaults. Bitcoin’s decentralization and high hash rate make this improbable, while smaller proof-of-work coins are more vulnerable.

Market Manipulation and Whales

Due to the relatively nascent nature of the cryptocurrency market, Bitcoin is susceptible to market manipulation by large holders, commonly referred to as “whales.” These individuals or entities hold substantial amounts of Bitcoin and can influence the market with large trades.

Whale Manipulation

Whales can create significant price movements by buying or selling large quantities of Bitcoin at once. For instance, if a whale decides to sell a large portion of their holdings, it can trigger panic selling among smaller investors, leading to a sharp price drop. Conversely, large purchases can cause sudden price increases.

Pump-and-Dump Schemes

Like other cryptocurrencies, Bitcoin is occasionally targeted by pump-and-dump schemes, where groups of investors artificially inflate the price of an asset before selling off their holdings for profit, leaving latecomers to suffer the losses.

Lack of Regulation

Unlike traditional financial markets, which are subject to strict regulations against insider trading and manipulation, Bitcoin markets operate in a more unregulated environment, making them more vulnerable to these manipulations.

Conclusion

Bitcoin has tremendous rewards but several risks that investors must consider. Bitcoin’s dangers are complex and ever-changing, from price volatility and regulatory uncertainty to cybersecurity and environmental issues. Investors must understand these dangers and manage them as the Bitcoin industry evolves. Understanding Bitcoin’s risk profile is essential for making educated decisions in this volatile market.