Understanding Fidelity Bitcoin ETF Price: Latest Insights and Trends

Fidelity Bitcoin ETF Price: Many investment vehicles are already available to satisfy the growing demand from institutions interested in Bitcoin as the cryptocurrency sector develops further. Fidelity Investments’ Bitcoin Exchange-Traded Fund (ETF) is a highly anticipated product in this field. This article explores the most recent news on the price of the Fidelity Bitcoin ETF, its effects on investors, and the potential outcomes.

What is a Bitcoin ETF?

Investing in a Bitcoin ETF is an excellent way to get a piece of the Bitcoin market without owning any Bitcoin. Instead, investors can buy and sell shares in these funds on regular stock exchanges because they hold Bitcoin on their behalf. This setup is perfect for institutional investors and regular people who aren’t comfortable with the ins and outs of Bitcoin trading because it simplifies and regulates the process.

Fidelity’s Entry into the Bitcoin ETF Market

One of the leading financial services companies, Fidelity Investments, has pioneered options for investing in digital assets. A significant step for Bitcoin’s legitimization as an investment asset was the company’s 2023 filing for a Bitcoin ETF. Without the hassle of owning Bitcoin, investors can still benefit from the cryptocurrency’s performance thanks to the exchange-traded fund (ETF) that aims to track its price.

Several companies have recently applied to the SEC for permission to start Bitcoin exchange-traded funds (ETFs), and this film fits in with that trend. Many have speculated that Fidelity’s ETF could serve as a model for similar products in the future, thanks to its stellar reputation and extensive background in asset management.

Latest Developments and Current Price Insights

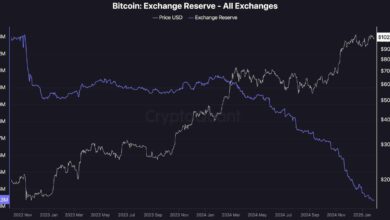

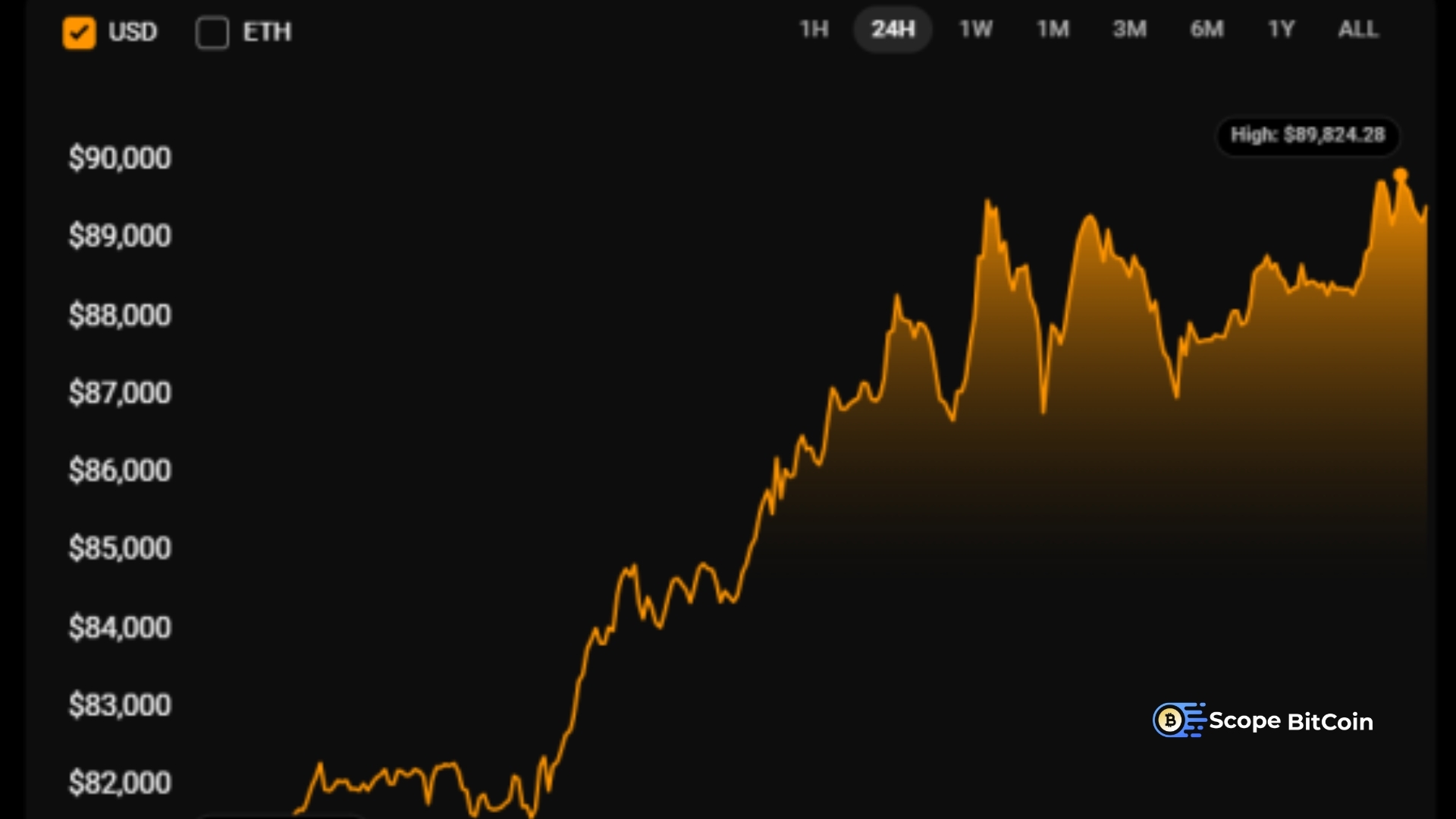

There has been a lot of buzz around the Fidelity Bitcoin ETF since August 2024. Some Bitcoin exchange-traded funds (ETFs) have recently begun to receive permission from the SEC, and although Fidelity’s exact approval timeframe is unclear, anticipation is still high. As Bitcoin’s price has fluctuated wildly over the years, investors anticipate that the Fidelity Bitcoin ETF’s first public offering (IPO) pricing will follow like.

The Fidelity Bitcoin ETF price is anticipated to reflect changes in real-time real-time trades at various price points. For example, if Bitcoin’s price surges because of more adoption or positive regulatory news, the ETF price will also increase. On the other hand, the ETF’s value can fall if the market experiences a slump or regulations encounter roadblocks.

Market Impact and Investor Sentiment

When the Fidelity Bitcoin ETF launches, the market will suffer far-reaching consequences. Increased accessibility for individual and institutional investors could result in more demand for Bitcoin, leading to price stability in the long run. Investors have been interested in investing in a regulated product that provides exposure to Bitcoin while also adding security and convenience.

Despite Bitcoin’s volatile past, market sentiment is still hopeful. Many anticipate that institutional investment will aid Bitcoin’s future growth in light of recent market entries by large firms like Fidelity. More conventional investors may be enticed by Fidelity’s ETF, which might pave the way for individuals who were reluctant to invest in cryptocurrencies to do so.

Challenges and Considerations

Even if a Fidelity Bitcoin ETF is something to get excited about, there are some things to consider and obstacles to overcome. In the past, the SEC has delayed licenses for Bitcoin ETFs due to worries about market manipulation and the lack of oversight in the cryptocurrency markets. The launch of Fidelity’s ETF will depend on how well the company handles these concerns.

Furthermore, investors face risks due to Bitcoin’s intrinsic volatility. Although ETFs can help reduce this risk, direct ownership still involves some risk. Before entering the Bitcoin market through an ETF, prospective investors should consider their investment plan and risk tolerance, both long and hard.

What to Expect Moving Forward

In the future, the price of the Fidelity Bitcoin ETF will be affected by several things, including the following:

Regulatory Developments: Continued engagement with the SEC and regulatory bodies will shape the timeline for the ETF’s launch. More precise guidelines and regulations could facilitate a smoother approval process for Fidelity and other asset managers.

Bitcoin Market Dynamics: Bitcoin will remain the primary driver of the ETF’s price. However, market trends, macroeconomic factors, and technological advancements within cryptocurrency will also play a role.

Institutional Adoption: As more institutions adopt and invest in Bitcoin-related products, the market will likely become more stable and mature. Fidelity’s ETF could accelerate this trend by providing a trusted investment vehicle.

Investor Education: As interest in Bitcoin grows, educating potential investors about the benefits and risks of investing in Bitcoin through an ETF will be essential. Fidelity’s resources and reputation could play a significant role in helping investors make informed decisions.

Final Words

One major step toward mainstreaming Bitcoin in the financial sector is the Fidelity Bitcoin ETF. With rising institutional interest and the possibility of broader market adoption, the ETF has the makings of a game-changer for investors looking to get into the Bitcoin market. Keeping a close watch on the Fidelity Bitcoin ETF price will be essential for comprehending the changing Bitcoin investment landscape as we anticipate regulatory decisions and market developments.

In conclusion, the Fidelity Bitcoin ETF has great potential to influence future Bitcoin market dynamics and investor sentiment. We may need to rethink our approach to Bitcoin investment in light of the impending sea change in the digital asset market brought about by ongoing innovations and increasing acceptance.