Swing Trading in Crypto: A Comprehensive Guide 2024

The goal of the trading approach known as “swing trading” is to profit from small price fluctuations that occur inside a bigger trend. Swing traders take advantage of market volatility by holding positions for short periods, usually a few days to a few weeks. To enter and exit this strategy, one needs to be skilled in technical analysis and know how to manage risk to avoid losses. Stocks, forex, and cryptocurrency are just a few financial markets that might benefit from swing trading.

Understanding Swing Trading

One common trading approach that bridges the gap between day trading and investing for the long haul is swing trading. Potentially benefiting traders from up and down price swings, it seeks to catch shorter-term price fluctuations inside a wider trend. Swing traders usually keep positions for several days to a few weeks, depending on the market circumstances and the particular trading setup.

Identifying Swing Trading Opportunities

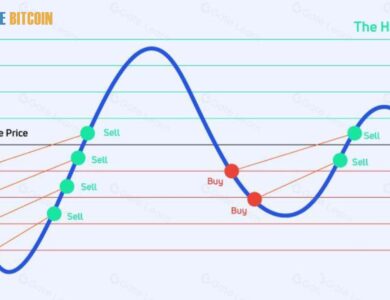

Knowing when to enter and exit a trade is crucial for successful swing trading. To anticipate market movements, traders frequently employ technical analysis indicators and tools to spot patterns such as trends, support and resistance levels, and possible swings. Swing traders often use the Stochastic Oscillator or Relative Strength Index (RSI), trendlines, Fibonacci retracements, and moving averages.

Additionally, swing traders watch news events and market catalysts that can affect the asset’s price. Swing traders can improve their entry and exit timing decisions by integrating technical and fundamental information.

Risk Management in Swing Trading

Swing trading, like any trading method, relies heavily on risk management. Swing traders employ a variety of risk management and capital protection strategies. A frequent strategy is to set stop-loss orders to close a position automatically if the price moves against the trader over a specific threshold. As a result, any losses are mitigated, and revenues are safeguarded.

Position sizing is another tool that swing traders employ to manage risk. A trader’s risk tolerance and the trade’s potential payoff dictate the optimal position size. Trading consistently and protecting oneself from large losses are two goals of swing traders who risk a tiny amount of cash on each trade.

Advantages of Swing Trading

Traders can benefit from swing trading in numerous ways:

- Flexibility: Swing trading allows traders to take advantage of short-term price movements without constantly monitoring the market.

- Profit Potential: Swing traders can generate profits in bullish and bearish markets by capturing price swings within a larger trend.

- Less Stress: Compared to day trading, swing trading typically involves fewer trades and less frequent decision-making, reducing the stress associated with constant monitoring of positions.

Disadvantages of Swing Trading

While swing trading has its advantages, it also comes with some drawbacks:

- Market Risk: Swing traders are exposed to market risk, as prices can move against their positions during the holding period.

- Missed Opportunities: Swing traders may miss out on short-term price movements outside their holding period.

- Psychological Challenges: Holding positions for several days or weeks can test a trader’s patience and discipline, especially during market volatility.

Tools and Platforms for Swing Trading

- Crypto Exchanges: Platforms like Binance, Coinbase, and Kraken offer a range of tools and features for swing trading. They provide real-time data, charting tools, and various order types.

- TradingView is a popular charting tool that offers a wide range of technical indicators, drawing tools, and customizable charts. Swing traders use it for its user-friendly interface and comprehensive analysis features.

- Crypto Portfolio Trackers: Tools like CoinMarketCap or Blockfolio help traders monitor their investments, analyze their portfolios, and track market prices.

- Trading Bots: For those who prefer a more automated approach, trading bots can execute trades based on pre-set strategies and indicators. Bots like 3Commas or Cryptohopper are popular choices.

Applying Swing Trading to Cryptocurrencies

Several financial markets, including cryptocurrency markets, are amenable to swing trading. Cryptocurrencies are great for swing trading due to their volatility; prices can fluctuate quickly.

Traders engaging in swing trading in cryptocurrency should consider the market’s peculiarities, such as its extreme volatility, liquidity, and the influence of news and regulatory changes. It is also possible to find cryptocurrency-specific technical analysis indicators and tools that could lead to profitable swing trades.

Conclusion

Swing trading in cryptocurrency offers opportunities to profit from short- to medium-term price movements. Traders can confidently navigate the volatile crypto market by understanding key concepts, developing a solid strategy, and employing effective risk management techniques. However, it is essential to remain adaptable, stay informed about market trends, and continuously refine your trading approach to achieve long-term success in swing trading.

Whether you are a seasoned trader or just starting, swing trading can be a rewarding and dynamic approach to trading cryptocurrencies. With the right tools, strategies, and mindset, you can position yourself for success in this exciting and ever-evolving market.