Money Markets Functions, Key Instruments, and Impact on Finance

The Money Markets Functions market allows lending and borrowing funds for shorter periods, making it an essential part of the financial system. Because of their liquidity, money markets are crucial to the economy’s and financial markets’ health. In addition, this article provides a primer on money markets, covering their structure, purpose, possible influence on other financial markets, and the leading players and tools that make them work.

What Are Money Markets?

The Cryptocurrency Trading of investments in short-term debt is known as the money market. The money market is a structured marketplace for buying and selling high-quality debt instruments with one-year or shorter maturities. Treasury bills (T-bills), CDs, commercial paper, and repos are all examples of highly liquid securities traded in these markets.

Governments, banks, businesses, and other significant institutions rely on money markets to generate funds to meet short-term cash flow demands. Money markets also allow regular people to put their money into short-term, low-risk securities.

Key Participants

The main participants in money markets include:

- Banks and financial institutions: These are the primary participants. They use money markets to manage their liquidity needs and to lend excess reserves.

- Corporations: Companies use money markets to finance their short-term operational needs through instruments like commercial paper.

- Governments: They issue T-Bills to manage their short-term funding requirements.

- Investment funds: Money market mutual funds invest in short-term instruments and offer investors a way to invest in money markets.

- Retail investors: Individual investors can participate indirectly through mutual funds in the money market or through instruments like T-Bills and CDs.

Key Instruments

Various financial instruments are exchanged over the counter (OTC) in money markets. In addition, Factors such as supply and demand, monetary policy decisions made by central banks, and general economic conditions impact the interest rates and prices found in money markets.

Money market instruments include some of the following:

- Treasury bills (T-bills): Short-term government securities with maturities ranging from 4 to 52 weeks. They are considered one of the safest money market instruments.

- Certificates of deposit (CDs): Issued by banks and credit unions, CDs are time deposits that pay interest upon maturity, typically ranging from a few weeks to several months.

- Commercial paper: Unsecured, short-term debt instruments that corporations issue to finance their working capital needs.

- Repurchase agreements (repos): Repos are Short-term agreements in which one party sells securities to another with a commitment to repurchase them later and at a higher price.

- Bankers’ acceptances are short-term debt instruments that a commercial bank guarantees, often used in international trade transactions.

Functions of Money Markets

Money markets serve several crucial functions in the financial system:

- Financing trade and industry: Money markets provide short-term domestic and international trade financing and working capital for sectors.

- Investing excess reserves: Commercial banks can also invest their excess reserves in money market instruments, earning interest while maintaining liquidity.

- Implementing monetary policy: Central banks use money markets to influence short-term interest rates and implement economic policy.

- Facilitating liquidity management: Money markets allow financial institutions and corporations to manage their liquidity by borrowing or lending funds on a short-term basis.

- Investment opportunities: Individual investors can also earn returns on their idle cash by investing in money market funds, which invest in various money market instruments.

Impact on Financial Markets

The money market’s function in maintaining stability and liquidity has far-reaching consequences for the entire financial system. Here are a few significant effects:

Financial Stability and Liquidity

Money markets are essential for banks and other financial organizations to run efficiently. Banks depend on these markets to handle their day-to-day financial demands and reserve requirements. This liquidity depends on the banking system’s stability and financial institutions’ ability to fulfill their obligations.

Interest Rates and Monetary Policy

Money markets are a tool that central banks like the US Federal Reserve employ to carry out monetary policy. By modifying the money supply, central banks impact borrowing costs, consumer spending, and investment, impacting short-term interest rates. Tools such as open market operations, which involve purchasing and selling government securities, directly affect the money market.

Investment Opportunities

Money markets provide investors with a low-risk investing alternative. Money market mutual funds are an excellent option for cautious investors or those looking for a short-term storage solution since they allow investors to receive returns on cash holdings with no risk.

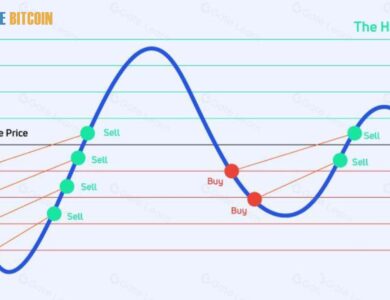

Impact on Cryptocurrency Markets

As cryptocurrencies and blockchain technology gain traction, the interplay between traditional money markets and digital assets becomes more relevant. Here are some potential impacts:

- Liquidity and stability: A well-developed money market could potentially provide more liquidity and stability to cryptocurrency markets, which have historically been volatile.

- Regulatory oversight: As cryptocurrencies become more mainstream, money markets could offer a regulated environment for trading and lending crypto assets, enhancing investor confidence and adoption.

- Integration with traditional finance: Integrating cryptocurrencies into money markets could facilitate their acceptance as a legitimate asset class and promote their use in mainstream financial transactions.

- Arbitrage opportunities: Differences in interest rates and lending conditions between traditional money markets and cryptocurrency markets could create arbitrage opportunities for investors and traders.

Nevertheless, many unanswered questions remain regarding the theoretical influence of money markets on Crypto Market Sentiment, and substantial legislative and technological hurdles exist. That must be overcome before any significant integration.

Summary

Finally, the money market is vital for executing monetary policy, liquidity provision, and short-term lending and borrowing. Institutions and investors can benefit from a firm grasp of money markets in both established and developing financial markets.