LATAM crypto news Argentina & Brazil’s BTC shift

LATAM crypto news update: Argentina fintech reform hits a setback while Brazil debates a national Bitcoin reserve strategy.

LATAM crypto news is entering a new phase defined less by speculation and more by structural decisions. Across Latin America, governments are no longer debating whether digital assets exist—they are debating who controls access, how they are regulated, and whether they belong in national financial strategy. Two recent developments illustrate this turning point clearly: Argentina’s fintech ecosystem has encountered a political setback tied to digital wallet salary deposits, while Brazil is revisiting the idea of holding Bitcoin as part of a sovereign reserve strategy.

These two stories capture the complexity of the region’s evolving crypto landscape. On one hand, Argentina has one of the highest real-world crypto usage rates globally, driven by inflation, currency instability, and a strong culture of digital payments. On the other hand, institutional and political resistance continues to shape how far fintech innovation can go. Meanwhile, Brazil—Latin America’s largest economy—is weighing whether Bitcoin should move beyond private portfolios and into the realm of state-managed reserves.

This LATAM crypto news cycle reveals a broader transformation. The conversation is shifting from retail enthusiasm and exchange launches toward legal frameworks, national strategy, financial infrastructure, and the long-term role of Bitcoin, digital wallets, and stablecoins in the regional economy. To understand where crypto is heading in Latin America, we must examine both Argentina’s regulatory friction and Brazil’s sovereign-level debate.

Why LATAM Crypto News Is Policy-Driven

In previous years, LATAM crypto news largely focused on adoption metrics, exchange growth, and grassroots usage. Today, the headlines increasingly revolve around legislation, regulatory approvals, compliance requirements, and government oversight. The region’s rapid crypto adoption forced policymakers to catch up—and now they are actively shaping the market’s next phase.

This shift is significant because regulation determines which players scale and which struggle. Virtual Asset Service Providers (VASPs), fintech apps, traditional banks, and payment processors must now navigate licensing standards, anti-money laundering rules, capital requirements, and custody regulations. The rules being written today will determine whether crypto remains primarily fintech-driven or transitions into a more bank-integrated model.

Argentina and Brazil represent two distinct but connected examples of this transformation. Argentina’s story is about payment rails and access. Brazil’s story is about sovereign legitimacy. Together, they define the trajectory of LATAM crypto news in 2026.

Argentina Fintech Faces Setback in Wage-to-Wallet Reform

Argentina has long been considered one of the most dynamic fintech markets in Latin America. Digital wallets are widely used for daily transactions, bill payments, peer-to-peer transfers, and increasingly for crypto-related services such as stablecoin savings. Yet recent LATAM crypto news highlights a political reversal that may slow the wallet ecosystem’s expansion.

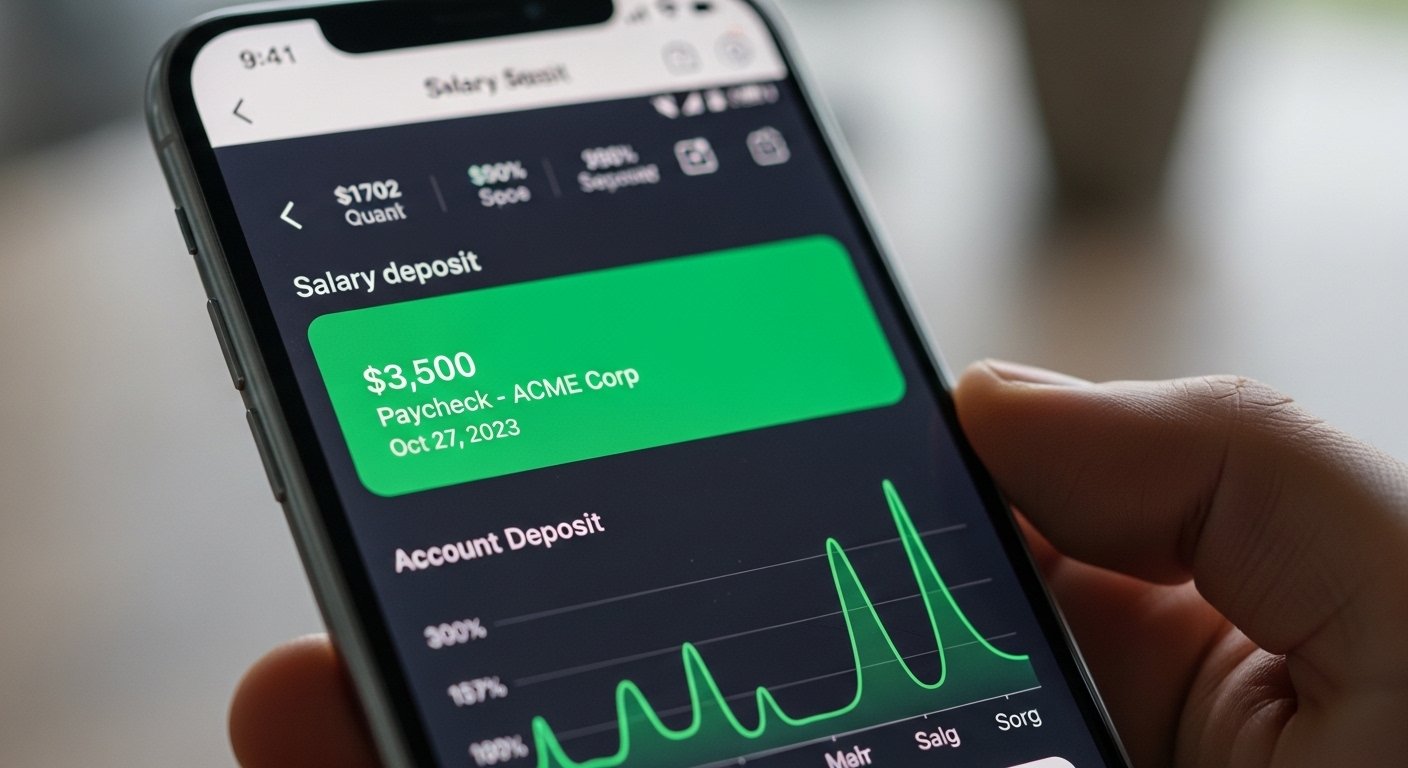

A proposal that would have allowed workers to choose to receive their salaries directly into digital wallets was removed from legislative reform discussions. The provision had been viewed as a significant opportunity for fintech platforms, as payroll deposits are one of the most powerful mechanisms for increasing user engagement and retention.

Why Salary Deposits Matter So Much

In financial ecosystems, payroll is foundational. When salaries are deposited into a particular account, that account becomes the user’s primary financial hub. From there, spending patterns, savings habits, and financial service adoption follow naturally.

If Argentine workers had been permitted to receive wages directly into digital wallets, it would have strengthened the position of fintech platforms relative to traditional banks. Users might have chosen to keep funds within wallet ecosystems, using integrated crypto payment features, stablecoin conversions, and merchant services without needing to move money back into bank accounts.

Blocking this reform preserves the dominance of traditional banking rails for salary deposits. Workers must continue receiving wages into bank accounts before transferring funds elsewhere. While this may seem like a small procedural detail, it significantly influences long-term platform growth and competition.

Banking Sector Influence and Competitive Tensions

The removal of the wage-to-wallet provision reflects ongoing tension between fintech disruptors and traditional financial institutions. Banks typically argue that non-bank wallet providers should be subject to equivalent regulatory standards if they handle core financial flows such as payroll deposits.

Fintech advocates counter that innovation thrives when consumers are given flexibility and that digital wallets already operate within regulated payment frameworks. They argue that preventing direct salary deposits limits competition and slows the modernization of financial services.

This tension is a recurring theme in LATAM crypto news. Across the region, governments are attempting to balance innovation with financial stability. Argentina’s recent decision suggests that, at least for now, banking interests maintain strong influence in shaping policy outcomes.

Argentina’s Crypto Regulation Is Still Advancing

Despite the fintech setback, Argentina is not turning away from digital assets. In fact, regulatory frameworks for crypto exchanges, wallet providers, and other virtual asset services are becoming more structured. Authorities are implementing clearer registration and compliance requirements for service providers operating in the country.

This signals a dual-track approach. On one track, fintechs face political limitations regarding direct payroll flows. On the other, crypto regulation is being formalized, potentially opening doors for traditional banks to offer crypto trading, custody, and related services.

The Bank-Led Crypto Possibility

If banks receive approval to offer crypto services while wallet providers face restrictions on salary deposits, Argentina could evolve into a bank-led crypto market. In this model, traditional institutions would integrate Bitcoin and digital asset services directly into existing banking apps.

Such a shift would reshape the competitive landscape. Fintechs might pivot toward user experience innovation, cross-border payments, or specialized services, while banks leverage regulatory credibility and deposit relationships to dominate crypto offerings.

For LATAM crypto news observers, the key question is whether policymakers eventually revisit the wage-to-wallet issue. Public demand for flexibility remains strong, especially in a country where citizens frequently use digital tools to hedge against currency depreciation.

Brazil Weighs a National Bitcoin Reserve

While Argentina’s story centers on payment infrastructure, Brazil’s contribution to LATAM crypto news is far more symbolic. Policymakers are debating whether the country should establish a Strategic Bitcoin Reserve as part of its broader financial strategy. The concept of a Bitcoin reserve typically involves the state holding Bitcoin as an asset, potentially as a diversification measure alongside traditional foreign currency reserves and gold. The proposal has sparked debate among lawmakers, economists, and financial analysts.

What a Bitcoin Reserve Could Look Like

The structure of a national Bitcoin reserve could take multiple forms. Brazil could allocate a small percentage of national reserves to Bitcoin as a hedge against global financial instability. Alternatively, it could create a sovereign investment vehicle dedicated specifically to digital assets.

More ambitious versions of the proposal suggest multi-year acquisition strategies, positioning Brazil as a global leader in state-level crypto adoption. However, such approaches require robust governance frameworks, secure custody mechanisms, and clear risk management policies. The difference between a symbolic allocation and a large-scale accumulation strategy is significant. Even a modest reserve position would send a strong signal that Bitcoin is being treated as a legitimate macroeconomic asset.

The Strategic Rationale Behind the Debate

Supporters argue that Bitcoin offers diversification benefits and aligns with Brazil’s growing fintech and blockchain ecosystem. As global conversations around digital assets evolve, some policymakers view a Bitcoin reserve as a way to position Brazil at the forefront of financial innovation. Critics highlight volatility concerns, arguing that public funds should not be exposed to assets known for dramatic price swings. They also raise questions about custody security, transparency, and accountability in managing digital reserves.

This debate reflects broader global trends. Countries worldwide are reconsidering reserve composition in an era of geopolitical tension, inflationary pressures, and technological disruption. Brazil’s internal discussion places it squarely within that global narrative.

Comparing Argentina and Brazil in LATAM Crypto News

Argentina and Brazil illustrate two different dimensions of crypto integration. Argentina’s focus is microeconomic—who controls payroll rails and consumer wallet access. Brazil’s discussion is macroeconomic—should Bitcoin be part of national reserves? Together, these developments redefine LATAM crypto news. The region is no longer merely adopting crypto at the grassroots level. It is integrating digital assets into institutional and governmental structures.

Argentina shows that innovation can be slowed by political resistance even in high-adoption markets. Brazil demonstrates that digital assets are entering strategic policy discussions at the highest levels. Both cases highlight a common reality: crypto in Latin America is transitioning from disruptive experiment to regulated infrastructure.

What Comes Next for LATAM Crypto Markets?

Looking ahead, several factors will shape upcoming LATAM crypto news. In Argentina, renewed legislative efforts could attempt to reintroduce wage-to-wallet reforms in a modified format. Regulatory clarity for VASPs and potential bank integration of crypto services will determine whether the ecosystem becomes more centralized or remains diversified.

In Brazil, the Bitcoin reserve debate may evolve into formal legislation or be scaled back to smaller pilot initiatives. Even if a full reserve is not adopted, the discussion alone legitimizes digital assets within sovereign financial planning. Across the region, stablecoins, CBDC research, cross-border payment innovation, and institutional crypto custody will continue influencing policy decisions. Latin America’s unique economic challenges ensure that crypto remains highly relevant.

Conclusion

The latest LATAM crypto news underscores a powerful reality: digital assets in Latin America are no longer fringe technologies. They are central to policy, competition, and national strategy. Argentina’s fintech setback reveals how deeply entrenched financial structures can influence innovation pathways. Limiting wage-to-wallet deposits may slow fintech momentum, but it does not eliminate crypto’s role in the country’s economy. Regulatory frameworks continue to evolve, and bank participation may increase.

Brazil’s Bitcoin reserve debate represents a different frontier entirely. By even considering a sovereign Bitcoin allocation, Brazil signals that digital assets have reached macroeconomic significance. Whether the proposal advances or stalls, the discussion itself reshapes how policymakers view crypto.

For investors, entrepreneurs, and analysts, LATAM crypto news in 2026 is about institutionalization. The region is defining how digital assets fit into payment systems, banking models, and even national reserves. The outcome will influence not only Latin America but also global perceptions of crypto’s long-term role in finance.

FAQs

Q: Why is Argentina’s wage-to-wallet issue important in LATAM crypto news?

Because payroll deposits are a foundational financial flow. Allowing salaries to be paid directly into digital wallets would strengthen fintech platforms and accelerate crypto adoption.

Q: Is Argentina becoming anti-crypto?

No. While a fintech reform was blocked, crypto regulation and potential bank involvement in digital assets continue advancing.

Q: What is a Strategic Bitcoin Reserve?

It is a proposal for a country to hold Bitcoin as part of its national reserves, similar to gold or foreign currencies.

Q: Why would Brazil consider holding Bitcoin?

Supporters argue it offers diversification and positions Brazil as a leader in digital asset innovation.

Q: How does this affect the broader Latin American crypto market?

These developments indicate that crypto is moving from grassroots adoption into formal financial and governmental frameworks, shaping the region’s long-term digital economy.

See More: Bitcoin Price Near $70K as Altcoins Soar