Ethereum Floods Out of Exchanges Since October

Ethereum floods out of exchanges in the biggest withdrawal wave since October. Learn what it means for supply, whales, staking, and price.

Ethereum floods out of exchanges in a way we haven’t seen since October, and that single on-chain behavior has become one of the most watched signals in the crypto market. When Ethereum floods out of exchanges, it usually suggests that holders are moving ETH away from instant sell access and into destinations that are harder—or less convenient—to liquidate quickly. That can include cold storage, self-custody wallets, staking, and DeFi protocols. Even though withdrawals alone don’t guarantee a rally, the size of this movement matters because it reflects a shift in how investors want to hold ETH right now.

The phrase “biggest withdrawal wave since October” is important because it frames this as more than everyday exchange activity. Exchanges see constant deposits and withdrawals, but a large net outflow over a short period can indicate a coordinated preference for holding rather than selling. This is especially meaningful in Ethereum’s case, because ETH is not only a traded asset—it is also network “fuel” for fees and smart contracts, a staking asset that can generate yield, and a primary collateral asset across DeFi. So when Ethereum floods out of exchanges, you are often seeing both financial positioning and ecosystem usage happening at once.

In this article, you’ll learn what it really means when Ethereum floods out of exchanges, why “since October” is a useful market benchmark, what might be driving the movement, and how this can affect ETH price and volatility. We’ll also explore how exchange reserves, netflow, whale activity, and staking participation fit together so the story flows naturally—without hype and without over-optimization.

What It Means When Ethereum Floods Out of Exchanges

When Ethereum floods out of exchanges, the most direct impact is on liquidity. Exchanges are where ETH is easiest to sell quickly. If large amounts of ETH leave exchange wallets, the immediately available pool of coins that can hit the market shrinks. That doesn’t force price up by itself, but it can change the market’s “supply shape” and influence how price reacts to demand.

This is why traders and analysts pay attention to on-chain exchange data. In simple terms, if more ETH is being withdrawn than deposited, the market is seeing a net outflow. When Ethereum floods out of exchanges in a sharp wave, it often suggests that holders are moving into a longer-term posture. They might be reducing counterparty risk, deploying into staking, or positioning for future catalysts. All of these behaviors push ETH away from instant trading venues.

At the same time, it’s important to keep perspective. Ethereum floods out of exchanges can happen even during sideways or bearish periods. Sometimes people withdraw because they want to hold through volatility. Other times they withdraw to use ETH elsewhere—such as in decentralized lending markets. So while the data is valuable, it’s most powerful when combined with price action, sentiment, and broader macro conditions.

Exchange Netflow vs. Exchange Reserves

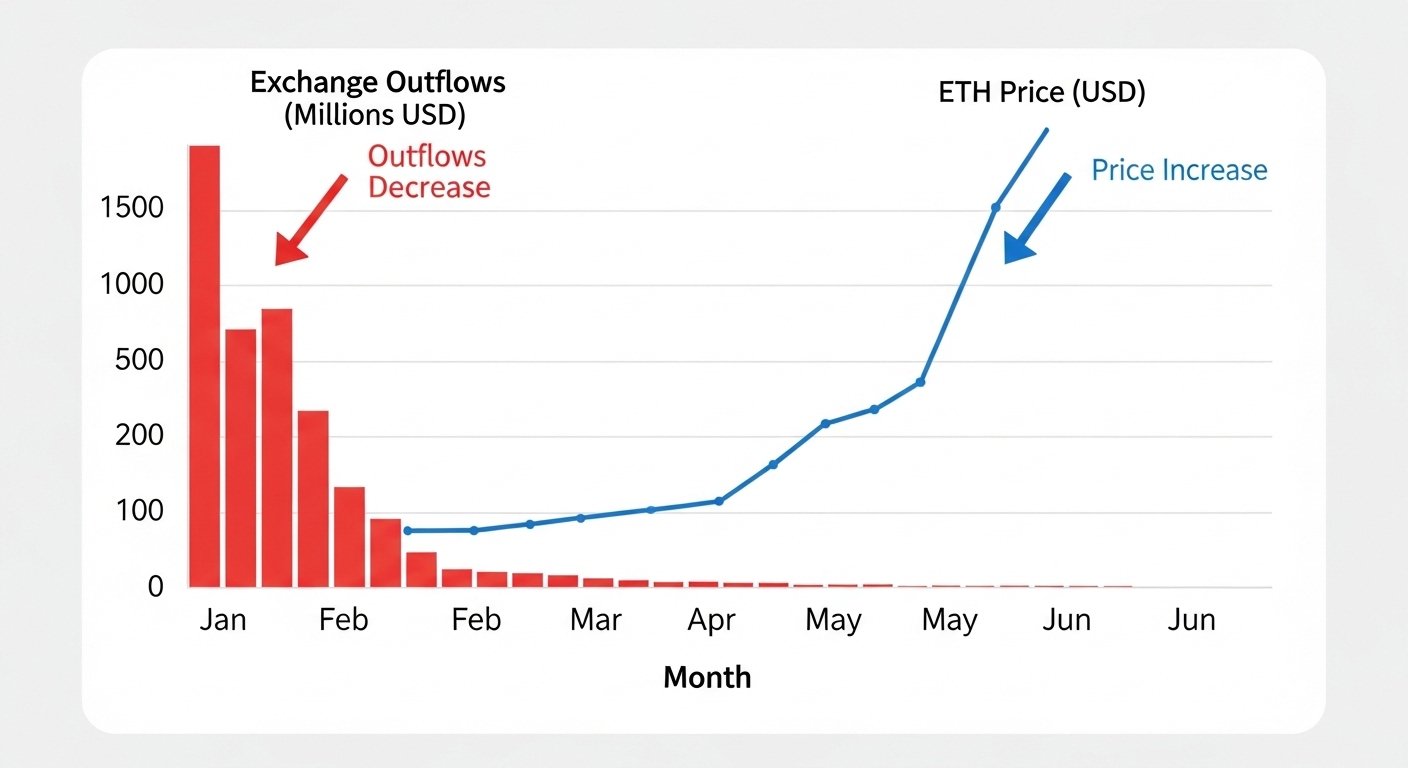

A common confusion is mixing exchange netflow with exchange reserves. Netflow describes what happened over a time window—say, the past day, the past three days, or the past week. If Ethereum floods out of exchanges over 72 hours, netflow will show a strong negative figure during that period.

Exchange reserves describe the total ETH held on exchanges at a given time. Reserves change more gradually, though big withdrawal waves can cause noticeable drops. Netflow is a short-term “motion” indicator, while reserves are a “stock” indicator. The best analysis looks at both. A one-day outflow can be noise, but repeated waves that reduce total reserves can reshape market liquidity.

Why “Biggest Withdrawal Wave Since October” Is a Big Deal

Saying Ethereum floods out of exchanges in the biggest wave since October is meaningful because it highlights an unusual magnitude compared to recent months. Markets operate on memory. Traders remember prior liquidity shifts, prior volatility regimes, and prior turning points. When the market sees the biggest withdrawal wave since October, it signals that the current behavior is not routine—it’s notable relative to a timeframe that many participants still have fresh in mind.

This type of benchmark matters in two ways. First, it suggests a bigger-than-normal relocation of ETH away from centralized trading venues. Second, it often creates a narrative catalyst: people begin to interpret the outflows as accumulation, reduced sell pressure, or strategic repositioning. Narratives alone don’t move markets forever, but they can influence short-term momentum, especially when paired with thin liquidity.

Still, the key is not to treat “biggest since October” as a guaranteed bullish trigger. It is best understood as a structural hint. It tells you that the market’s immediate sell-side inventory may be shrinking. Whether that becomes price strength depends on demand, confidence, and the broader environment.

Why October Works as a Reference Point

October is used as a reference point because it represents a recent and memorable period where conditions may have been meaningfully different—volatility, trend direction, or investor sentiment. When Ethereum floods out of exchanges in the biggest wave since October, you are essentially being told: this is the strongest “move off exchanges” behavior in months. That alone makes it worth analyzing closely.

Where Is the ETH Going When It Leaves Exchanges?

When Ethereum floods out of exchanges, it doesn’t disappear. It moves to other places, and those destinations help explain the likely motivation behind the trend. The most common destinations are self-custody wallets, cold storage, staking, and DeFi.

Self-custody and cold storage reduce exchange-side liquidity, and they also reduce exchange exposure. Staking reduces liquid supply in a different way by encouraging holders to keep ETH committed for yield and network participation. DeFi introduces nuance: ETH can be “off exchange” but still economically active, used as collateral, supplied into lending pools, or paired in liquidity positions.

Understanding these destinations helps you interpret the signal more accurately. If Ethereum floods out of exchanges while staking participation climbs, the outflows may reflect yield-seeking and long-term holding. If outflows coincide with rising DeFi activity, it may reflect capital deployment rather than simple storage.

Self-Custody and Cold Storage: A Long-Term Signal

A meaningful share of outflows can reflect long-term conviction. Investors who plan to hold through volatility often prefer moving ETH into wallets they control. This shift can be especially common during uncertain periods, when people feel more comfortable owning their keys than leaving assets on a platform.

When Ethereum floods out of exchanges into self-custody, it can reduce immediate sell pressure, because selling now requires moving funds back to an exchange. That added friction doesn’t prevent selling, but it can slow the process and reshape short-term liquidity dynamics.

Staking: Turning ETH Into a Yield Asset

Ethereum’s proof-of-stake system encourages a different kind of holding behavior than earlier crypto cycles. Instead of letting ETH sit idle, many holders prefer to stake for yield. That can turn “holding ETH” into an income-generating strategy, which often supports longer holding periods.

If Ethereum floods out of exchanges because holders are staking, it suggests a structural preference: investors want to treat ETH less like a short-term trading chip and more like a productive asset. Over time, this can reduce exchange-held ETH and make the market more sensitive to bursts of demand.

DeFi Deployment: Off-Exchange Doesn’t Always Mean Illiquid

When Ethereum floods out of exchanges into DeFi, ETH can remain liquid in a different environment. It can be swapped on decentralized exchanges, used as collateral, or supplied to liquidity pools. This doesn’t eliminate the effect of reduced centralized exchange liquidity, but it does mean selling pressure can shift venues. That’s why a mature view treats outflows as a liquidity redistribution rather than a one-way lockup. ETH can be off exchanges and still be traded—just through different rails.

The Whale Factor: Are Big Holders Driving This?

Large withdrawal waves often involve whales. Retail withdrawals happen, but dramatic net outflows over a short period are frequently associated with large holders moving capital strategically. When Ethereum floods out of exchanges in the biggest wave since October, it’s reasonable to consider that whales and funds may be involved.

Whales may withdraw for several reasons. They may want self-custody for security. They may be allocating to staking products. They may be repositioning ahead of market catalysts. Or they may be moving coins for treasury management, custody consolidation, or over-the-counter settlement.

The challenge is that whale activity is not automatically bullish. Whales are not a single team—they have different time horizons and motives. However, large net outflows can indicate that, on balance, big players are not preparing to sell aggressively at market price right now.

Exchange Outflows vs. Whale Selling: How to Tell the Difference

If whales were preparing to sell, you would often see the opposite: a rise in deposits to exchanges. So when Ethereum floods out of exchanges, it can reduce the probability of immediate, large-scale spot selling—at least through centralized venues. The best confirmation comes from observing whether this behavior persists and whether exchange balances continue to trend down.

How Exchange Outflows Can Affect ETH Price

When Ethereum floods out of exchanges, the biggest market impact is potential sell-side supply reduction. If demand remains stable or rises, reduced liquid supply can support price. If demand weakens, price can still fall—but the selling may occur more slowly or with different liquidity mechanics.

Price is determined at the margin, meaning small changes in available liquidity can have outsized effects during active periods. If ETH is leaving exchanges and a burst of buying arrives—whether from spot buyers or institutional flow—price can move quickly because the order books may be thinner.

But there’s another crucial piece: derivatives. ETH trades heavily in perpetual futures and options, and those markets can drive price swings even if spot supply is moving off exchanges. A leveraged unwind can push price down even during net outflows. That’s why it’s wise to treat outflows as a structural backdrop rather than a single all-powerful signal.

Why Ethereum Floods Out of Exchanges Can Increase Volatility

Reduced liquidity can amplify moves in both directions. If the market gets bullish, fewer coins on exchanges can make upward moves sharper. If the market gets bearish, thin liquidity can also create fast drops and wicks. In other words, when Ethereum floods out of exchanges, it can make the market more reactive. The practical implication is that traders should be careful with leverage during periods where exchange liquidity is changing rapidly. Long-term holders should watch for confirmation that outflows are persistent rather than temporary.

Market Psychology: What This Says About Investor Behavior

Beyond mechanics, when Ethereum floods out of exchanges, it often reflects a psychological shift: less eagerness to trade, more willingness to hold. That’s why “biggest since October” resonates. It implies that investors are behaving differently than they have for months. This could be driven by renewed confidence in Ethereum’s long-term role, expectations of future catalysts, or simple risk management—moving assets off exchanges during uncertainty. Any of these can be true at once. Crypto markets often move because multiple narratives align, not because a single narrative dominates.

Confidence vs. Caution: Two Interpretations

If Ethereum floods out of exchanges during a stabilizing market, it can be read as confidence and accumulation. If it happens during uncertainty, it can also be read as caution and self-protection. Both interpretations reduce exchange-held supply, but they imply different emotional drivers. To separate confidence from caution, watch what happens next. If price begins to form higher lows and outflows continue, that often aligns with accumulation. If price weakens while outflows slow, it may have been defensive repositioning rather than a strong bullish bet.

Staking, Layer 2 Growth, and Ethereum’s Structural Demand

Ethereum is more than a token price chart. The network’s usage—fees, settlement demand, and activity across Layer 2s—can influence investor behavior. As Ethereum scales through Layer 2 ecosystems, ETH’s role as settlement collateral and economic base layer can reinforce long-term holding narratives.

When Ethereum floods out of exchanges during periods of ecosystem growth, it can reflect investors treating ETH as a long-term infrastructure asset. When it floods out during uncertain conditions, it may reflect investors preferring self-custody while remaining committed to ETH’s long-term story.

The ETH Value Proposition and the Off-Exchange Trend

ETH benefits from multiple demand drivers: it powers transactions, it underpins smart contracts, it supports DeFi, and it can generate staking yield. This multi-use structure encourages people to move ETH into places where it can “work,” not just sit on an exchange. That’s why Ethereum floods out of exchanges can be more than a trading signal—it can be a reflection of how investors use ETH inside the ecosystem.

What to Watch Next: Confirmations That Matter

When Ethereum floods out of exchanges in the biggest withdrawal wave since October, the most important question is whether this is a one-off spike or the start of a sustained trend. The market tends to reward sustained changes more than sudden one-day events. Watch whether exchange balances continue falling over the next weeks. Watch whether net outflows repeat.

Watch whether price stabilizes and begins reclaiming key levels. Also watch whether exchange inflows rise suddenly—because that can indicate that holders are moving ETH back to sell after a short-term rebound. Finally, keep an eye on broader market conditions. Ethereum does not move in isolation. If Bitcoin volatility spikes or macro markets shift sharply, ETH can be pulled along regardless of on-chain flow patterns.

A Balanced Take Without Over-Hype

The best interpretation is nuanced: Ethereum floods out of exchanges suggests lower immediate sell-side supply on centralized venues. That is often supportive, but it is not a guarantee. It increases the importance of demand. If demand arrives, the market can move faster. If demand fades, outflows may simply signal that holders prefer to wait elsewhere.

Conclusion

Ethereum floods out of exchanges in the biggest withdrawal wave since October is a strong signal that liquidity is being redistributed away from instant trading venues. Whether the driver is self-custody, staking, DeFi deployment, or institutional custody, the shared effect is that more ETH is sitting off exchanges and less is sitting where it can be sold immediately with a click. That can reduce short-term sell pressure and reshape market structure, making ETH more sensitive to changes in demand.

However, this is not a magic bullish switch. When Ethereum floods out of exchanges, the market still needs demand, confidence, and stable conditions to convert reduced liquid supply into sustained price strength. The smartest approach is to treat this as an important on-chain clue—then look for confirmation through continued outflows, declining exchange reserves, and improving price behavior.

FAQs

Q: What does it mean when Ethereum floods out of exchanges?

It means more ETH is being withdrawn from centralized exchanges than deposited, indicating a net outflow. This often reflects self-custody, staking, or DeFi usage.

Q: Is it always bullish when Ethereum floods out of exchanges?

Not always. It can reduce immediate sell pressure, but price still depends on demand, sentiment, macro conditions, and derivatives positioning.

Q: Why is “biggest withdrawal wave since October” important?

Because it suggests the outflow is unusually large compared with recent months, making it more meaningful than normal day-to-day exchange movement.

Q: Where does ETH usually go after leaving exchanges?

Common destinations include cold storage, self-custody wallets, staking, and DeFi protocols. Each affects liquidity differently.

Q: What should I watch after a big exchange outflow event?

Watch whether outflows persist, whether exchange reserves keep declining, whether price stabilizes or strengthens, and whether sudden exchange inflows return (which can hint at profit-taking).

Also Read: Ethereum Price Analysis ETH Drops in Descending Channel